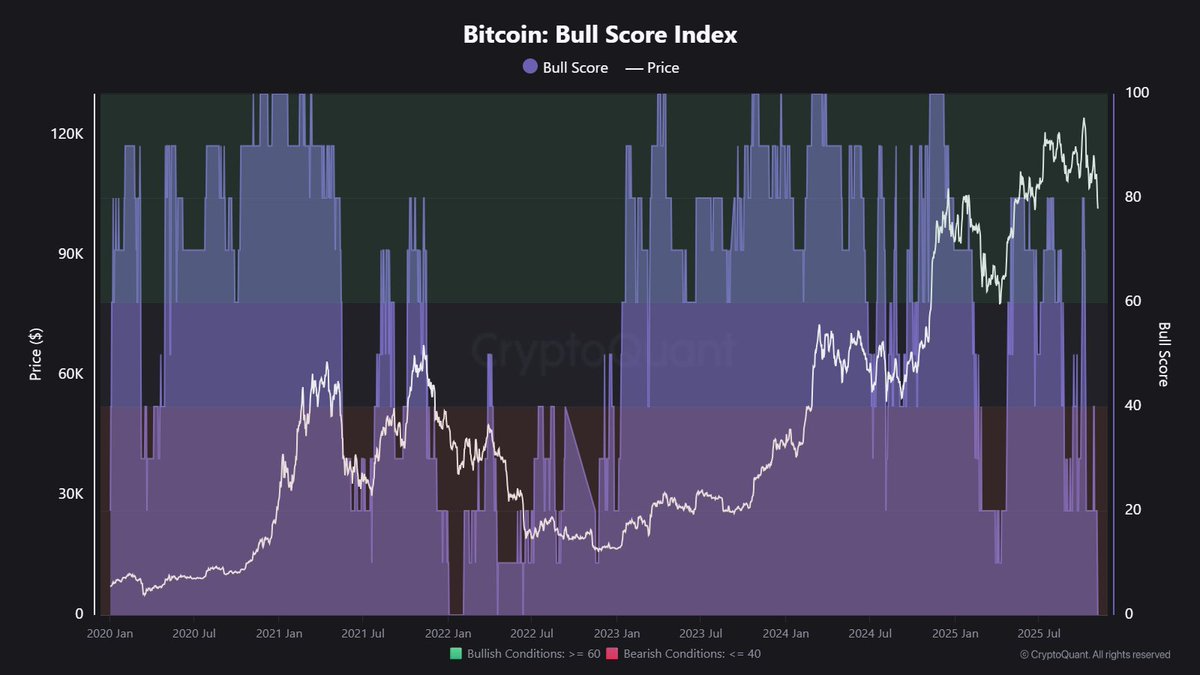

Bull Rating, a key on-chain metric used to evaluate Bitcoin’s upside potential, plummeted to zero out of 10 factors. That is the primary time the rating has reached zero since January 2022, which preceded the final main bear market.

Information from on-chain analytics platform CryptoQuant confirmed that the Bullscore indicator hit zero on Thursday. Analysts warned that speedy motion was wanted to keep away from a protracted recession.

Bullish rating suggests a transfer in the direction of consolidation

BullScore is a composite indicator designed to evaluate market well being and developments by integrating 10 totally different on-chain and market indicators throughout 4 main classes. This contains community exercise, buying and selling quantity, investor profitability, and market liquidity.

Bitcoin: Bullish Rating Index. Supply: CryptoQuant

Usually, a rating under 40 is interpreted as a bear market sign, and a rating above 60 is interpreted as a bull market sign.

As of November, all 10 on-chain elements of this metric are under pattern. Most notably, the MVRV (market worth to realized worth) and liquidity of stablecoins on the Bitcoin community have fallen dramatically over the previous month.

When Bitcoin’s MVRV ratio decreases, it often signifies a decline in profitability for buyers. Relying on the scenario, it may point out potential undervaluation or a purchaser re-entry zone.

A decline in MVRV means the market worth is transferring nearer to or under the holder’s common price foundation. Merely put, buyers’ unrealized features and even losses are decreased.

Bitcoin MVRV ratio for the previous 3 months. Supply: CryptoQuant

Though the rating remained extraordinarily low all through the 2022 bear market, the present scenario is structurally totally different provided that Bitcoin stays at historic highs close to $100,000.

Nonetheless, why are the symptoms exhibiting such outcomes? It is as a result of inflows from ETFs and firms have slowed.

Total, it’s clear that new demand must materialize for a sustained bull market to happen. Analysts say the present regime seems to be within the early phases of a bear market.

The put up Bitcoin Bull Rating Hits Zero for the primary time for the reason that 2022 bear market appeared on BeInCrypto.