Regardless of a pointy market correction that erased greater than 20% from current highs, massive Bitcoin holders are quietly accumulating once more, displaying renewed confidence.

On the time of writing, Bitcoin is buying and selling simply above $101,000, after briefly falling to $99,600 two days in the past.

Whales sign new hope for Bitcoin worth

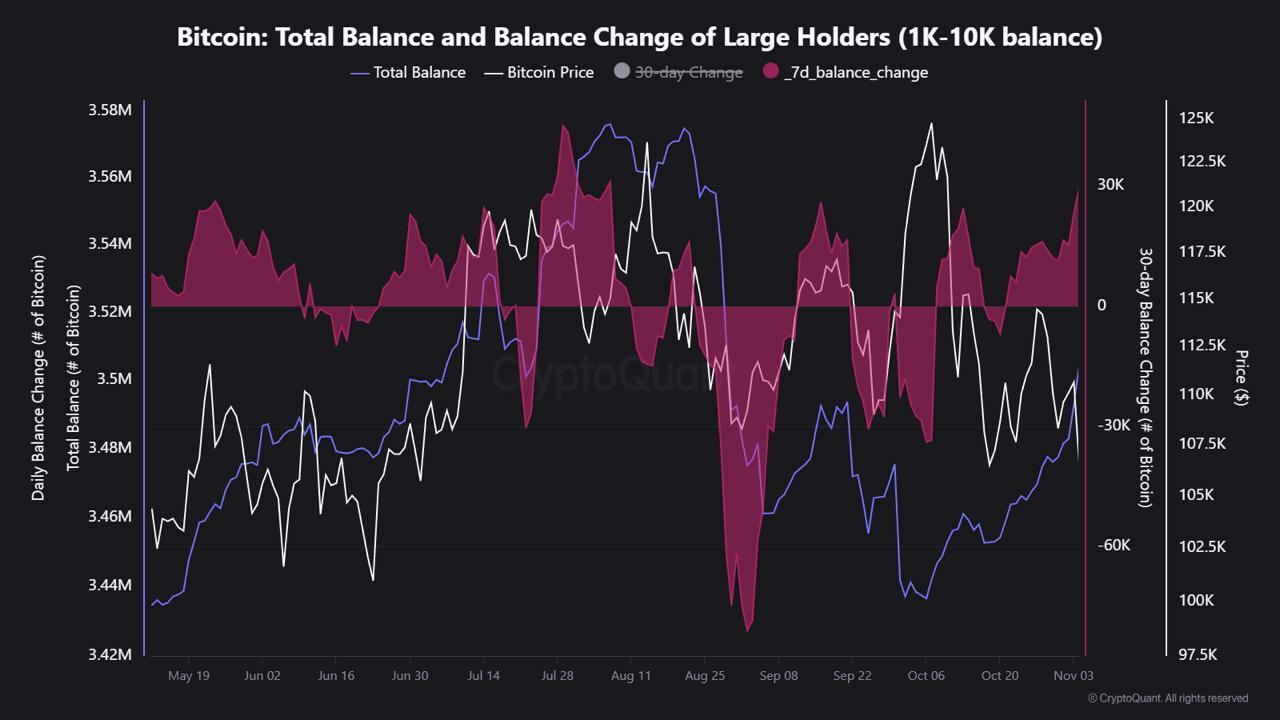

Added wallets holding 1,000 to 10,000 BTC in response to CryptoQuant information Roughly 29,600 Bitcoins Within the final 7 days.

Analyst JA Maartun mentioned that the overall stability of those whale wallets is 3.436 million to three.504 million BTC. This would be the first main accumulation part since late September.

Bitcoin whale stability. Supply: CryptoQuant

This information suggests that giant firms (often establishments or early whales) are shopping for into weaknesses quite than working away from them. Their actions are in sharp distinction to retail sentiment, which has been spooked within the wake of mass liquidations and ETF outflows.

Greater than $1 billion in leveraged positions had been worn out final week. In response to current market information, US spot Bitcoin ETF redemptions exceeded $2 billion.

This disconnect between “good cash” accumulation and retailer warning has traditionally characterised late-stage corrections quite than new downtrends.

By roughly absorbing 4x weekly mining quantitywhales are tightening liquid provides on exchanges and strengthening the $100,000 help zone.

This accumulation happens even amidst macro headwinds. The Fed’s cautious stance on decreasing rates of interest has weakened demand for danger belongings, contributing to Bitcoin’s current decline.

However the scenario has additionally created a liquidity vacuum, and whales seem like profiting from this chance.

JPMorgan predicts Bitcoin will hit $170,000 within the subsequent 6-12 months, saying it is resulting from PERP deleveraging and traditionally being undervalued relative to gold, suggesting “vital upside over the subsequent 6-12 months” pic.twitter.com/CaVVWH6L42

— Eric Balchunas (@EricBalchunas) November 6, 2025

How will Bitcoin finish in November?

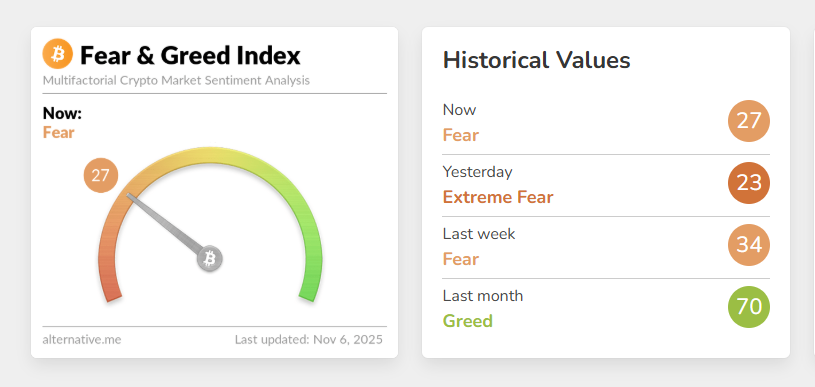

Technical indicators present that Bitcoin is consolidating between: $100,000 and $107,000In the meantime, the Concern and Greed Index lies deep within the “excessive worry” zone.

Traditionally, when massive holders enhance publicity in periods of heightened anxiousness, costs typically recuperate inside weeks.

Nonetheless, there may be nonetheless potential for elevated volatility within the brief time period. Extended institutional outflows and by-product unwinding might go away markets unstable earlier than a sustained restoration happens.

Cryptocurrency Concern and Greed Index. Supply: Alternate options

Nevertheless, if whale accumulation continues, it might type the idea for a medium-term restoration in the direction of $115,000-$120,000.

The takeaway from this week’s whale watching is evident. Whereas short-term merchants are panicking, long-term holders are repositioning for the subsequent leg.

Their regular accumulation suggests confidence that the market’s structural tendencies are intact, even when sentiment has not but caught up.

The put up Whales Quietly Purchase Push as Bitcoin Checks $100,000 Assist appeared first on BeInCrypto.