The month-long drop in cryptocurrency costs has not solely harm main property resembling Bitcoin (BTC) and Ether (ETH), but additionally inflicted heavy losses on digital asset treasury firms that had constructed their enterprise fashions round accumulating cryptocurrencies on their stability sheets.

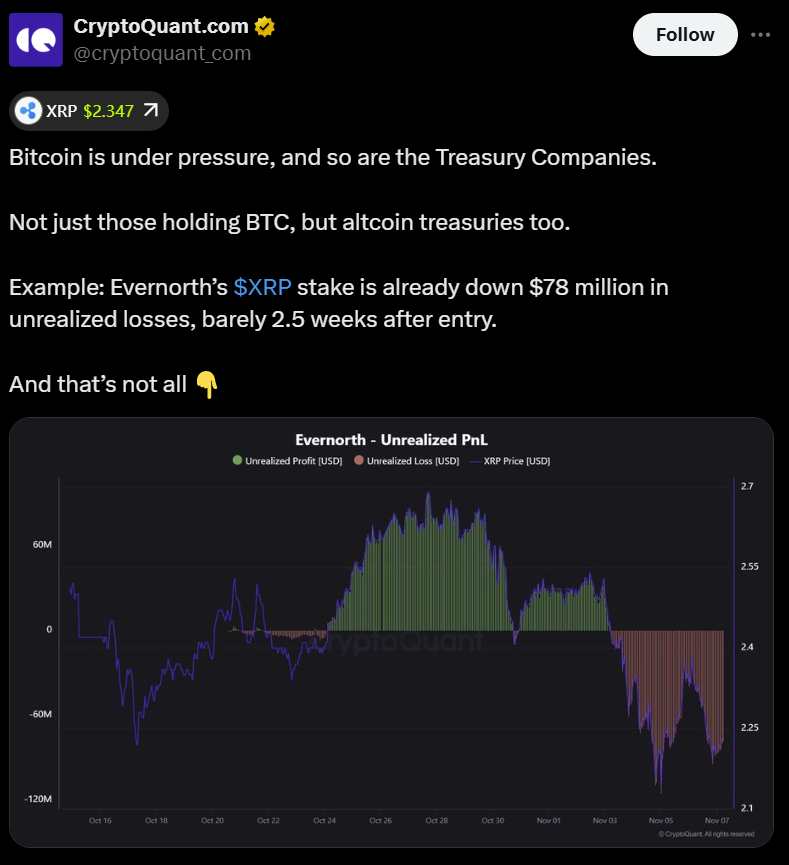

This is among the key takeaways from a current social media evaluation by on-chain information agency CryptoQuant, which cited XRP-focused monetary agency Evernorth as a major instance of the dangers on this area.

Evernorth reportedly incurred roughly $78 million in unrealized losses on its XRP positions simply weeks after buying the property.

Because of this decline, the inventory worth of Bitcoin’s unique firm, Technique, Inc. (MSTR), additionally plummeted. The corporate’s inventory has fallen greater than 26% prior to now month as Bitcoin costs have fallen, in response to information from Google Finance. CryptoQuant famous that MSTR inventory has fallen 53% from its all-time excessive.

Nonetheless, Technique nonetheless has vital unrealized positive aspects on its Bitcoin reserves, at a median price of round $74,000 per BTC, in response to BitcoinTreasuries.NET.

sauce: cryptoquant

In the meantime, Bitcoin, the most important ether holder, at present has roughly $2.1 billion in unrealized losses associated to its ether reserves, in response to CryptoQuant.

In line with trade information, BitMine at present holds round 3.4 million ETH and has acquired greater than 565,000 prior to now month.

Digital asset treasury firm: Echoes of the dot-com bubble

Digital Asset Treasury (DAT) has come below rising valuation stress in current months, with analysts warning that the corporate’s market worth is more and more tied to the efficiency of its crypto holdings.

Some analysts, together with enterprise capital agency Breed, argue that solely the strongest gamers can face up to it, and word that Bitcoin-centered authorities bonds could also be finest positioned to keep away from a possible “loss of life spiral.” They are saying this threat stems from the collapse of an organization’s market web asset worth (mNAV), a metric that compares an organization’s worth to the market worth of its crypto investments.

Some liken the rise of digital asset treasury firms to the dot-com increase and bust of the early 2000s, an period ushered in by innovators with a long-term imaginative and prescient, not simply opportunists in search of short-term income.

Ray Youssef, founding father of peer-to-peer lending platform NoOnes, predicted that the majority digital asset vaults will finally disappear or collapse as market actuality units in.