Omid Malekan, an adjunct professor at Columbia Enterprise Faculty, stated banks and monetary establishments have begun experimenting with tokenized financial institution deposits, or financial institution balances recorded on blockchain, however the know-how is doomed to lose out to stablecoins.

Malekan stated over-collateralized stablecoin issuers, which should preserve 1:1 money or short-term money equal reserves to again their tokens, are safer from a legal responsibility perspective than fractional reserve banks that challenge tokenized financial institution deposits.

Stablecoins are additionally configurable, have permissions, know your buyer (KYC) controls, and might be transferred throughout the crypto ecosystem and utilized in quite a lot of functions, in contrast to tokenized deposits, which have restricted performance.

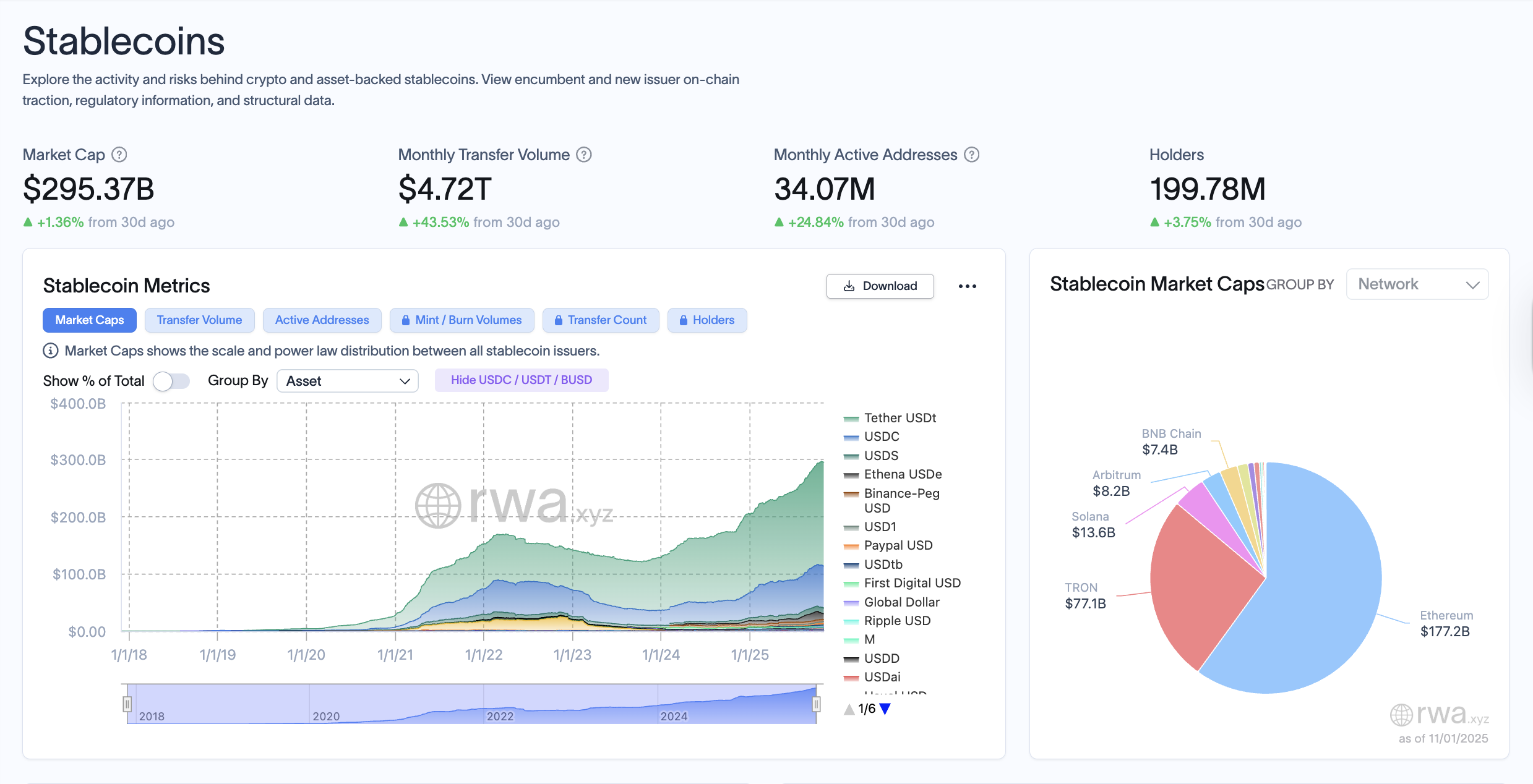

Stablecoins proceed to develop as an asset class. sauce: RWA.XYZ

Tokenized financial institution deposits are like “checking accounts that may solely write checks to different clients of the identical financial institution,” Malekan continued. He added:

“What does that imply? Such tokens can’t be used for many actions; they’re ineffective for cross-border funds, can’t serve the unbanked, don’t supply composability or atomic swaps with different property, and can’t be utilized in decentralized finance (DeFi).”

The tokenized real-world property (RWA) sector, which is bodily or monetary property tokenized on a blockchain, consists of fiat currencies, actual property, shares, bonds, commodities, artwork, collectibles, and extra, and is anticipated to develop to $2 trillion by 2028, in line with Commonplace Chartered Financial institution.

Associated: BNY considers tokenized deposits to energy $2.5 billion day by day funds community: Bloomberg

Stablecoin issuers share yields indirectly

Tokenized financial institution deposits can even must compete with yield-bearing stablecoins and with stablecoin issuers who discover methods to bypass the GENIUS Stablecoin Act’s yield ban and go on yield within the type of varied buyer rewards, Malekan argued.

Banking lobbies have opposed high-yielding stablecoins out of concern that stablecoin issuers sharing pursuits with clients might erode the banking trade’s market share.

At present, the common yield provided on retail financial institution financial savings accounts within the US or UK is effectively beneath 1%, and something above that’s engaging to clients.

The banking foyer’s resistance to high-yield stablecoins drew criticism from New York College professor Austin Campbell, who accused the banking trade of utilizing political stress to guard monetary pursuits on the expense of retail clients.

journal: Can tokenized shares from Robinhood and Kraken actually be diversified?