Bitcoin (BTC) had a quiet begin to November, holding regular round $110,350 after 24 hours of sideways buying and selling. The Bitcoin worth chart nonetheless suggests a potential reversal because the sample stays intact. This construction often suggests a big upward shift.

However regardless of this, BTC did not breakout. On-chain information explains what’s stalling the motion and what may in the end change it.

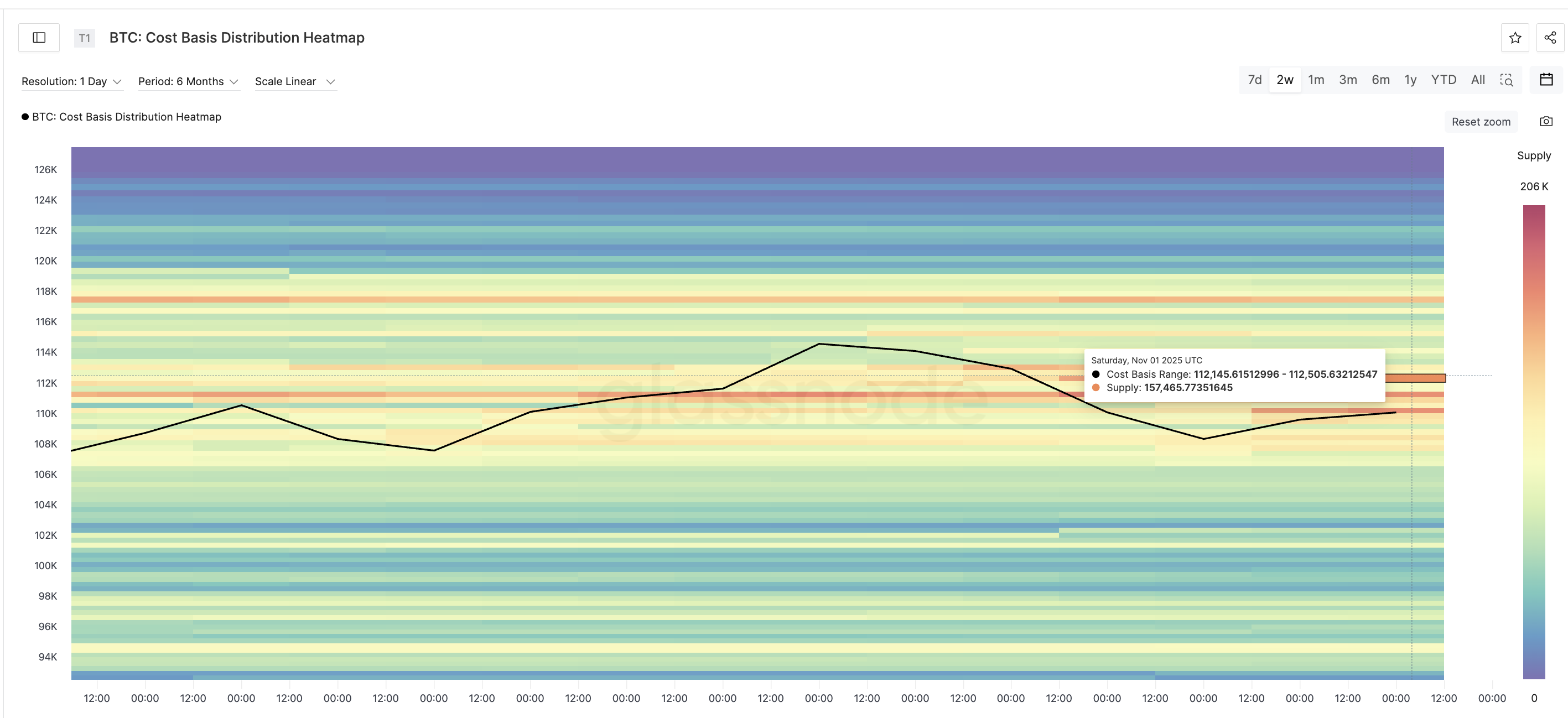

Price-based heatmap exhibits why breakout is stalled

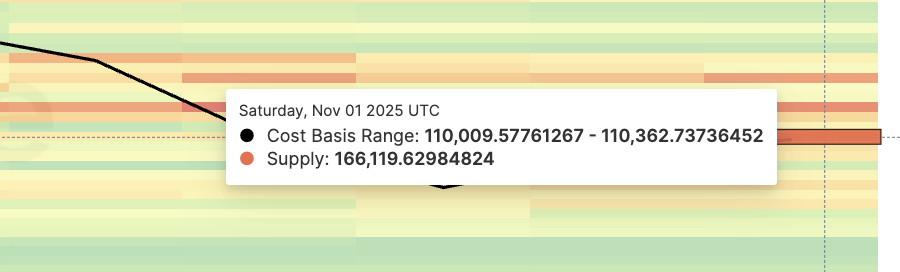

Bitcoin’s cost-based distribution heatmap (a chart that exhibits the place buyers final purchased a coin) highlights why BTC continues to battle round present ranges.

Between $110,000 and $112,500 there’s a zone of excessive provide the place roughly 434,000 BTC was final collected. These tight clusters usually act as resistance as many merchants who purchased at these ranges will think about promoting when the value returns to its price base.

One of many three main provide clusters (orange zones): Glassnode

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

Heatmaps assist determine the place giant pockets of holder exercise are concentrated and point out which worth ranges act as assist or resistance.

One other main BTC cluster: Glassnode

This explicit provide wall between $110,000 and $112,500 has been limiting BTC’s makes an attempt to maneuver greater all week. On the value chart (which we are going to focus on later), the identical stage coincides with necessary technical markers, reinforcing the validity of this vary.

The reversal sample will stay legitimate till Bitcoin closes firmly above $112,500, however pause and anticipate a transparent set off.

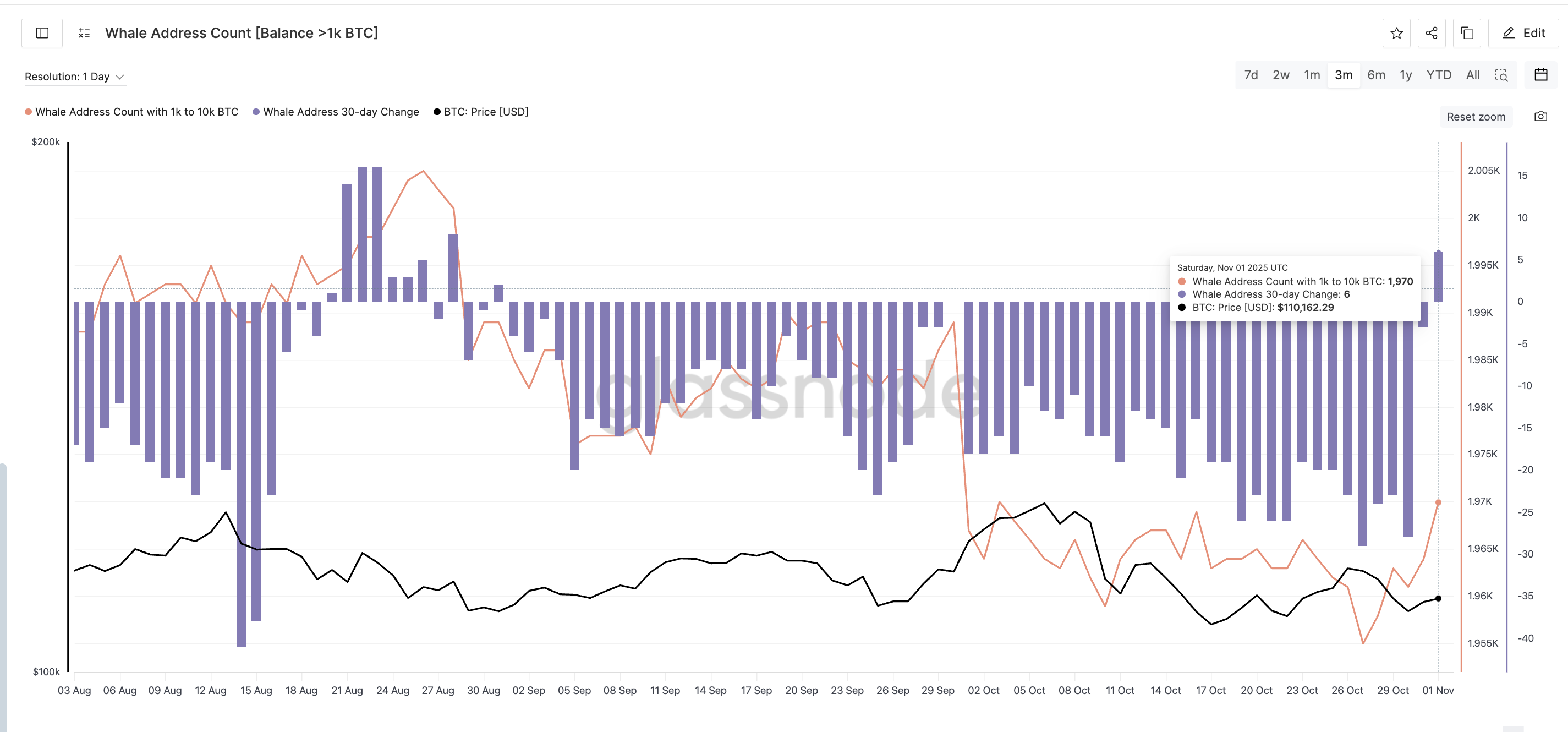

Whales could also be making ready to vary issues up

Whales could be the catalyst. On-chain information exhibits that giant wallets holding 1,000 to 10,000 BTC have resumed accumulation.

The 30-day change in whale domicile numbers turned constructive (+6) for the primary time since August 31, suggesting accumulation has resumed after a number of months of dormancy.

In the meantime, the whole variety of whale addresses dropped to a three-month low on October twenty seventh, however has since elevated and is now at about the identical stage because it was final seen on October third.

Bitcoin whale is again in motion: Glassnode

This rally exhibits renewed confidence within the huge gamers, a development usually seen earlier than a worth breakout. The dashboard that tracks these wallets additionally consists of change, ETF, and custodian addresses, providing you with a complete view of institutional exercise.

If this regular rally continues, it may assist BTC take up promoting stress close to $112,500 and set the stage for a possible breakout.

BTC Value Chart: Bullish Setup, Ready for a Set off?

Technically, Bitcoin remains to be buying and selling inside a transparent inverted head-and-shoulders formation. A breakout shall be confirmed if the value closes above $116,400 for the day, paving the best way to the targets of $122,000, $125,900, and $130,800.

Along with this bullish setup, the Relative Energy Index (RSI), a software that measures shopping for and promoting power, is displaying a bullish divergence.

From October twenty second to October thirtieth, the Bitcoin worth made new lows and the RSI made new lows. This transfer usually alerts a development reversal and the start of upward momentum.

Be aware that $112,590 is a serious resistance stage on the BTC worth chart. This stage checks the speculation of breakouts and stalls pushed by cost-based heatmaps. For BTC, this $112,500-$112,590 zone could possibly be an important zone within the brief time period.

Bitcoin Value Evaluation: TradingView

Nonetheless, if Bitcoin falls beneath $106,200, the breakout construction that is still intact may begin to lose form. An additional decline beneath $103,500 invalidates the whole bullish sample and confirms that the sellers have regained full management.

The put up Bitcoin Value Charts Nonetheless Scream Bullish — So Why Is the Breakout Stalled?The put up Bitcoin Value Charts Nonetheless Scream Bullish appeared first on BeInCrypto.