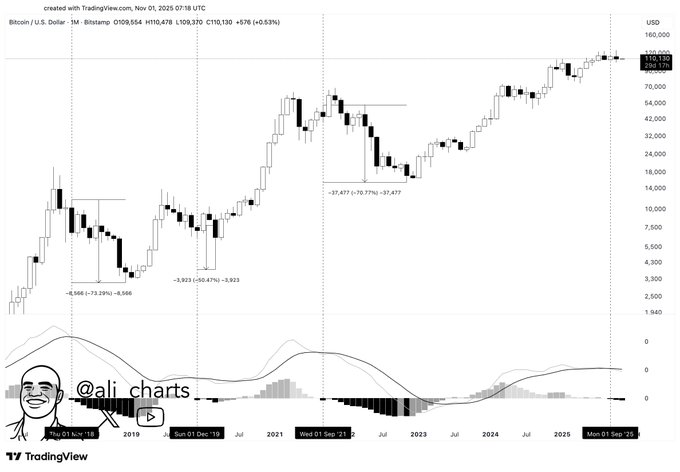

Famend crypto analyst Ali Martinez has recommended that Bitcoin (BTC) might attain $250,000 within the coming weeks if historic traits proceed.

This outlook relies on a comparability of Bitcoin’s present month-to-month worth construction and previous bull market cycles, particularly the parabolic rises of 2016-2017 and 2020-2021.

In a Nov. 1 X publish, Martinez famous that every of those cycles went by a interval of consolidation, adopted by a robust breakout that coincided with a bullish crossover within the MACD indicator, a preferred momentum indicator.

Presently, Bitcoin seems to be buying and selling in the same sample, with the MACD histogram turning optimistic, a sign that traditionally precedes an explosive progress part. Within the 2016 cycle, Bitcoin soared greater than 4,000%, whereas the 2020 bull market noticed it rise practically 1,500%.

If this sample repeats, Martinez suggests Bitcoin might mirror its exponential motion and attain $250,000 by December.

Such a transfer would require extraordinary momentum and a macro surroundings much like earlier peaks, together with sustained institutional inflows and renewed retail enthusiasm, particularly as Bitcoin enters a consolidation part close to $110,000 in November.

Has BTC worth reached its peak?

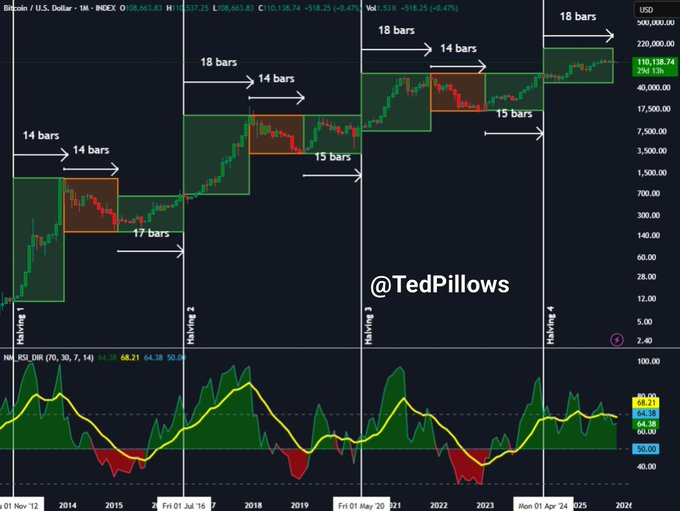

In reality, Bitcoin’s latest stall has given rise to hypothesis that Bitcoin could have already reached the height of the present cycle. However insights from crypto dealer Ted Pillows solid doubt on that notion.

In a Nov. 1 X publish, Pillows mentioned that in previous cycles, Bitcoin sometimes hit new all-time highs after a halving occasion, adopted by a speedy, euphoric rally and a pointy correction of 60% to 70%.

However this time, the story is altering. Bitcoin hit its first all-time excessive earlier than its halving in 2024, and the upward pattern since then has been extra secure than earlier explosive cycles.

The cryptocurrency additionally took practically six months to interrupt above the $100,000 degree, a transfer that isn’t typical of a blown ceiling, the place costs sometimes spike after which collapse rapidly, Pillows mentioned. He argued that extended integration suggests stronger structural foundations and continued institutional accumulation.

Whereas analysts acknowledge the potential of a pullback, Pillows argues that conventional post-peak patterns could not maintain true. He famous that the present settings signify a special market surroundings than earlier cycles.

Bitcoin worth evaluation

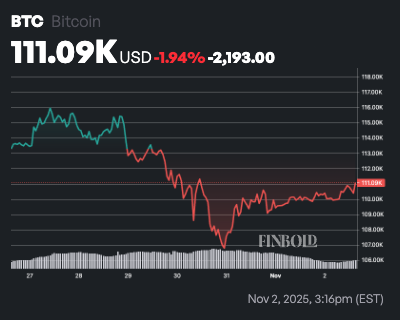

On the time of writing, Bitcoin was buying and selling at $111,076, up practically 1% up to now 24 hours however down about 2% on a weekly foundation.

At present ranges, Bitcoin is comfortably above its 50-day easy shifting common (SMA) of $114,247 and holds a premium above this key help degree, indicating near-term bullish momentum.

Nevertheless, it stays under the 200-day SMA of $105,861, reflecting a long-term bearish pattern and potential vulnerability to a big pullback if momentum weakens.

In the meantime, the 14-day Relative Energy Index (RSI) stood at 46.37, indicating neither overbought nor oversold circumstances, suggesting {that a} sideways consolidation is probably going within the brief time period until a decisive set off emerges.

Featured picture through Shutterstock