Bitcoin’s on-chain inflows display sturdy demand for the world’s largest cryptocurrency, with each buyers and miners growing exercise regardless of damaging market sentiment because the $19 billion crypto crash.

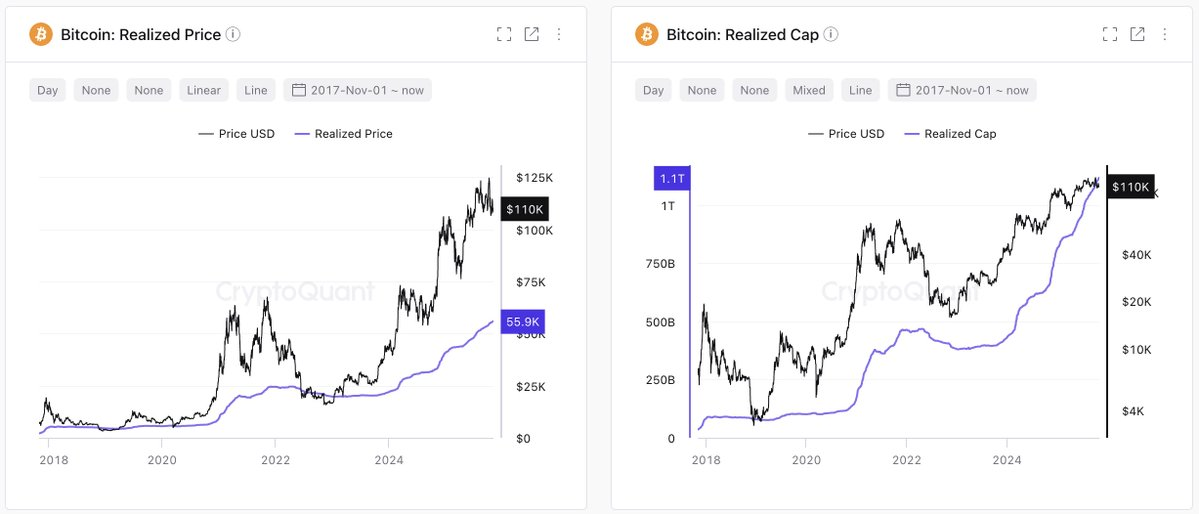

Over the previous week, the Bitcoin (BTC) realized cap rose by greater than $8 billion to over $1.1 trillion, because the realized value of Bitcoin (BTC) exceeded $110,000, indicating sturdy on-chain inflows.

Bitcoin’s Realization Cap measures the greenback worth of each coin at its final moved value and divulges the whole funding held by Bitcoin homeowners.

In keeping with Ki Younger Ju, founder and CEO of crypto evaluation platform CryptoQuant, the brand new inflows are primarily coming from Bitcoin treasury firms and exchange-traded funds (ETFs).

Nonetheless, till Bitcoin ETFs and Michael Saylor Technique resume large-scale acquisitions, Bitcoin’s value restoration will stay restricted, Ju wrote in a Sunday X publish, including:

“At the moment, demand is primarily pushed by ETFs and MicroStrategy, each of which have seen slower purchases not too long ago. As soon as these two channels get well, market momentum is more likely to return.”

sauce: cryptoquant

Associated: Saylor to tip $150,000 in Bitcoin in 2025 regardless of Trump tariff shock: redefining finance

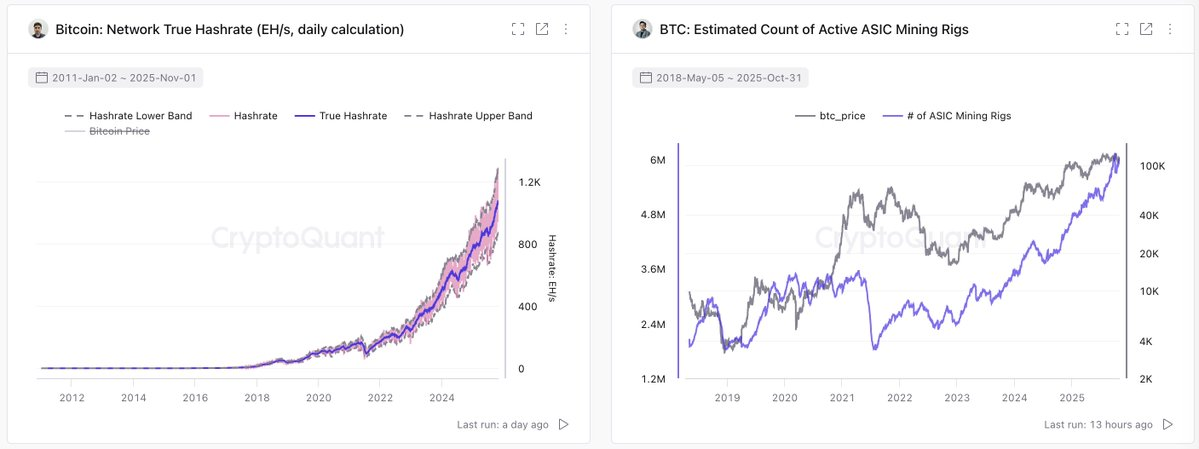

In the meantime, Bitcoin miners are increasing their operations, resulting in a rise in hashrate, which Zhu defined is a “clear long-term bullish sign” for the continued progress of the “Bitcoin cash vessel.”

Cointelegraph reported in August that a number of main Bitcoin miners have not too long ago expanded their mining fleets, together with Trump family-linked American Bitcoin, which bought 17,280 application-specific built-in circuits (ASICs) for about $314 million.

sauce: cryptoquant

Associated: Bitcoin is ‘too costly’ for retailers, threatening to finish bull market cycle

Bitcoin to $140,000 in November, depends upon ETF flows: Analyst

Regardless of $8 billion in new inflows, crypto investor sentiment has didn’t get well from “concern” territory because the report $19 billion market crash in early October.

Investor sentiment remained depressed although the White Home launched a sweeping assertion on Saturday outlining the commerce deal reached between President Trump and Chinese language President Xi Jinping.

Nonetheless, a resurgence in ETF inflows and a doable financial easing announcement by the Federal Reserve may push Bitcoin costs as much as $140,000 in November, an analyst on the Bitfinex alternate advised Cointelegraph, including:

“In our base case, we see Bitcoin rallying towards $140,000, so it might not be stunning to see complete ETF inflows of $10 billion to $15 billion.”

“Selling components embrace Fed easing with two fee cuts within the fourth quarter, doubling of ETF inflows, and powerful seasonal situations within the fourth quarter, though tariff and geopolitical dangers stay,” the analyst added.

journal: Bitcoin sees ‘one other huge push’ to $150,000, ETH strain will increase