Bitcoin miners suffered a large 6.31% issue enhance this week, pushing their ranking to a whopping 155.97 trillion. Nonetheless, miners continued to rampage via hashrates previous the 1,100 exahash per second (EH/s) mark, with block instances near the traditional 10-minute cadence.

October revenues rose barely, however Bitcoin miners face hardship

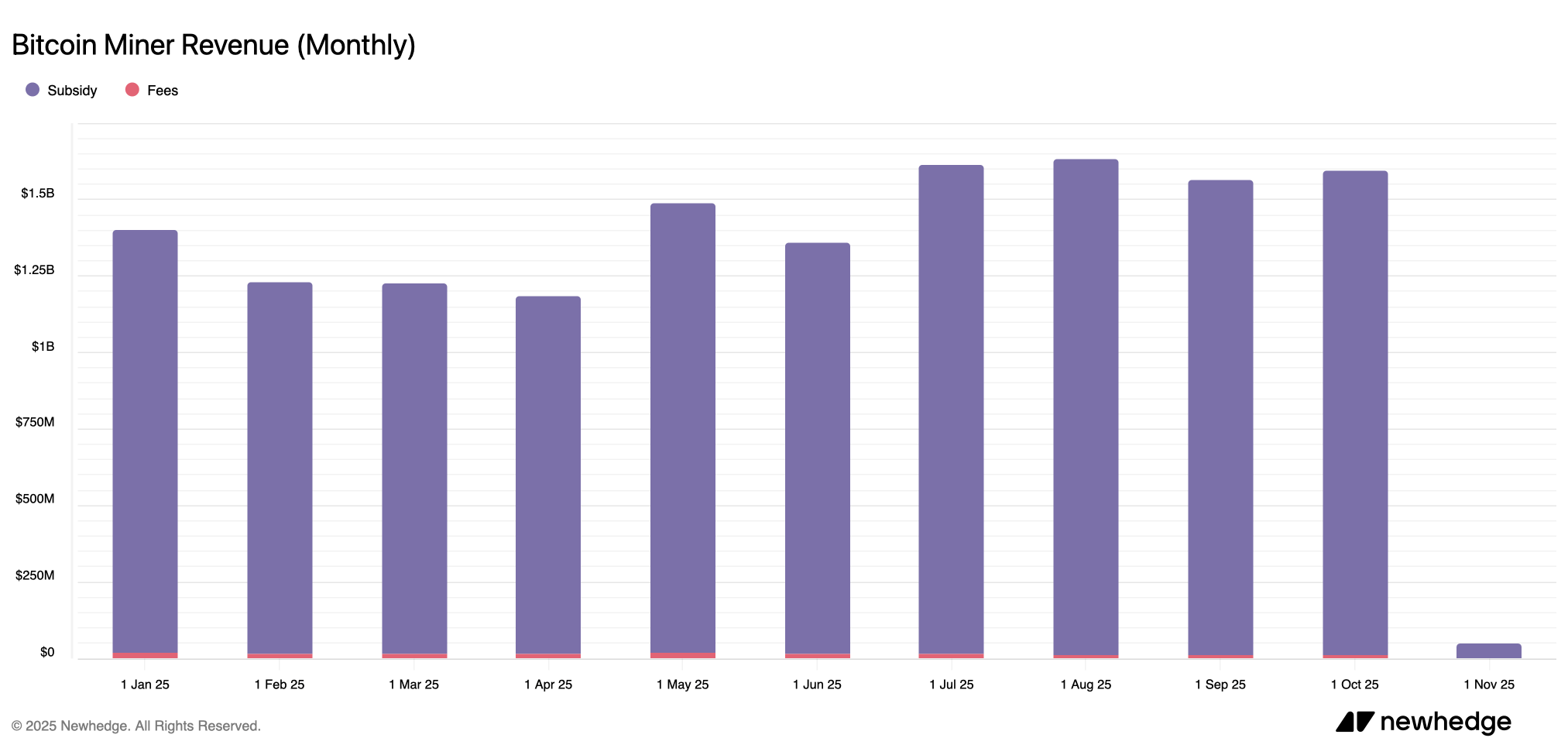

Bitcoin miners had been handled just a little higher in October, with about $1.595 billion in income, of which about $1.584 billion got here immediately from block subsidies, in line with numbers collected by newhedge.io.

This can be a modest enhance from September’s $1.564 billion harvest and can go away miners smiling at a further $31 million. General, the October wage seems contemporary, rising by 13.77% in comparison with January 2025 take-home pay.

As of Saturday, November 1st, hashrate is cruising at a refreshing velocity of 1,110.86 EH/s after spiking to 1,164 EH/s on October nineteenth, in line with community statistics from hashrateindex.com. Which means round 54 EH/s has been minimize since then, and miners are feeling the squeeze as Bitcoin’s worth has fallen and issue has elevated by 6.31%.

This newest issue enhance ranks because the third largest of the yr, behind the July 12, 2025 and April 5, 2025 issue retargets. In the meantime, the worth of Bitcoin has fallen this week, and hashprice, the estimated worth of 1 petahash per second (PH/s) of mining energy, has misplaced some luster since final month.

30 days in the past, the worth of PH/S was round $50.66; it’s now near $44.67. Buying and selling charges? But they proceed with the unreliable aspect hustles we have seen from final yr. On common, lower than 1% of the worth of every block reward goes to on-chain charges, or pennies in miner phrases. The typical price for Saturday block rewards is the same as 0.75% of the online worth of discovering a block.

Miners are most likely holding their heads excessive hoping that issues will degree out quickly, with Bitcoin costs returning to extra pleasant ranges and hash costs following swimsuit. Finally, profitability will depend on a fragile steadiness between issue, power prices, and market worth. Two of these three aren’t taking part in nicely.

As soon as costs rebound and hash costs get better, miners will lastly have some reduction and be capable to hold their rigs working with out sweating each block. For miners, like merchants watching charts with sweaty palms, it is a ready recreation. Nonetheless, in mining, persistence will not be solely nerve-wracking, but in addition consumes electrical energy and money.

Regularly requested questions ❓

- What’s the present mining issue for Bitcoin? Bitcoin mining issue just lately elevated by 6.31% to 155.97 trillion, the third largest enhance in 2025.

- How a lot did Bitcoin miners earn in October 2025?Miners raised about $1.595 billion in October, nearly all of which got here from block grants.

- What is going on to the Bitcoin hash worth?Hash worth has fallen from about $50.66 per PH/month a month in the past to about $44.67 at present.

- Why are the miners underneath stress now?Growing issue, falling Bitcoin costs, and low on-chain charges are squeezing miners’ earnings.