The Federal Reserve on Friday injected $29.4 billion into the U.S. banking system via an in a single day repo operation, the most important single-day transfer because the dot-com period. On the identical time, China’s central financial institution carried out a document money injection to shore up the home banking sector.

These concerted liquidity actions sign a tipping level for world threat belongings, notably Bitcoin (BTC). Merchants are watching carefully to see how central banks act to stabilize markets within the lead-up to 2026.

Fed’s liquidity measures spotlight market tensions

The Fed’s unusually giant in a single day repo operation was carried out in response to a pointy decline in U.S. Treasuries and mirrored rising tensions in short-term credit score markets.

🚨Breaking information on US banks

The Fed injected $29.4 billion into the US banking system via in a single day repos 🤯 This quantity far exceeds the height of the dot-com bubble 👀 It is most likely okay, preserve going pic.twitter.com/NsaoeJix0n

— Barchart (@Barchart) November 1, 2025

In a single day repos enable monetary establishments to trade securities for money, offering instantaneous liquidity when market circumstances develop into tight. The injection on October thirty first set a document in a long time, even in comparison with the dot-com bubble period.

Many analysts interpret this transfer as an apparent response to emphasize within the U.S. Treasury market. When bond yields rise and financing turns into dearer, the Fed typically steps in to restrict systemic threat.

These interventions additionally broaden the cash provide, an element that usually correlates with the rise in dangerous belongings akin to Bitcoin.

In the meantime, Fed Director Christopher Waller not too long ago referred to as for a price reduce in December and signaled a potential shift to extra accommodative coverage.

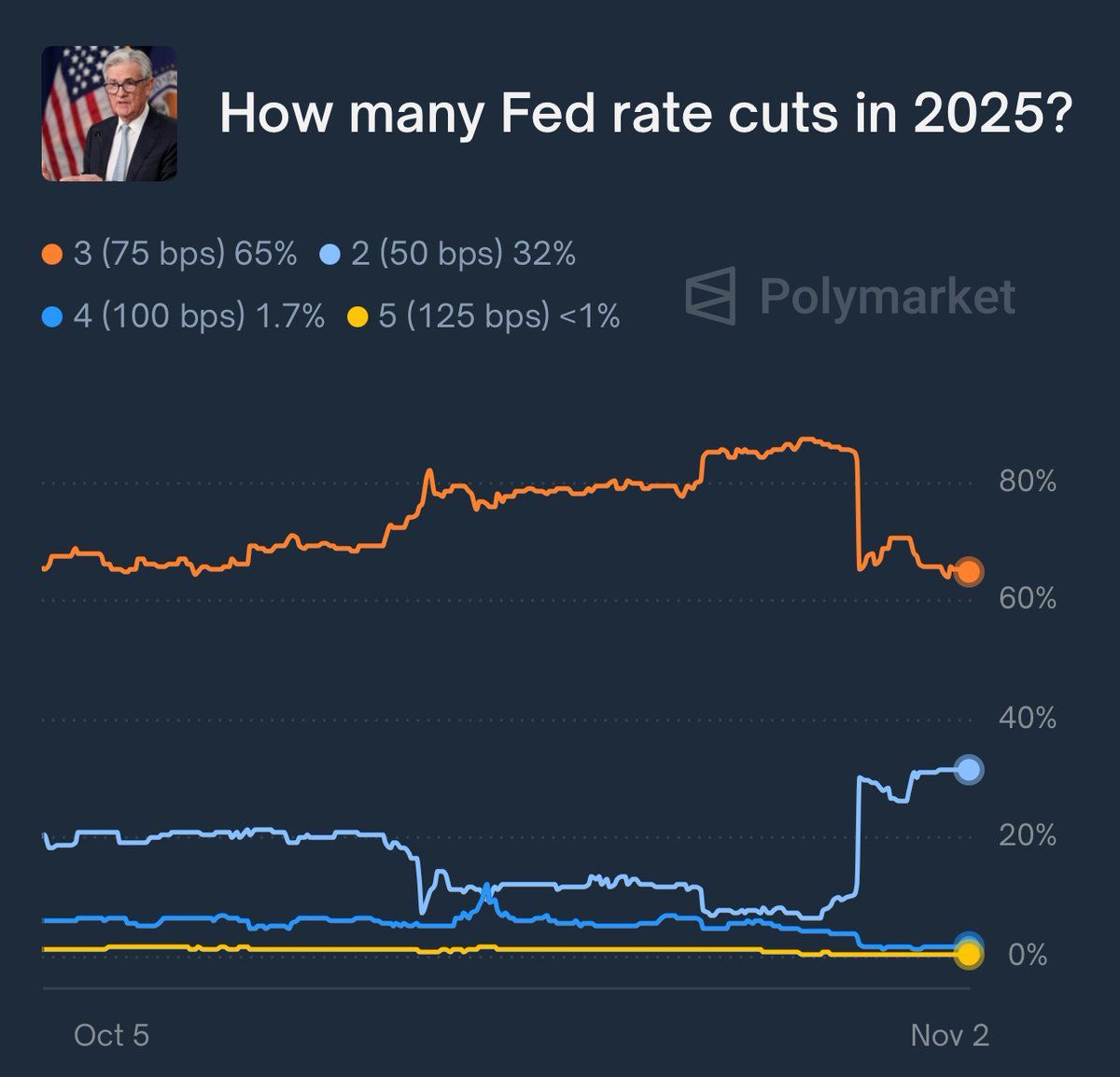

That is in distinction to Fed Chairman Jerome Powell’s earlier hawkish statements which have fueled market uncertainty and cautious statements. The chance of a 3rd price reduce in 2025 is between 90% and 65%, in keeping with Polymarket information, indicating a shift in expectations for financial coverage.

The chance that the Fed will reduce rates of interest 3 times in 2025 drops from 90% to 65%. Supply: Spherical Desk House

If the Fed fails to fulfill these expectations, markets might face a pointy decline. Buyers are already pricing in easing coverage, and a reversal might result in an outflow of capital from riskier belongings.

The issue in balancing liquidity injections and rate of interest coverage highlights the Fed’s challenges managing inflation and monetary stability.

China’s document money injection boosts world liquidity

In the meantime, the Individuals’s Financial institution of China additionally injected document money into home banks to assist financial progress as demand slows. The Individuals’s Financial institution of China (Central Financial institution) has elevated liquidity to stimulate lending and stop credit score tightening. The transfer comes because the Chinese language authorities grapples with deflation and a weakened actual property sector.

🏦 China’s M2 exceeded the US by greater than $25 trillion

For the primary time in trendy historical past, China’s cash provide M2 is greater than twice that of america.

🇨🇳 China M2: ≈ $47.1 trillion

🇺🇸US M2: ≈ $22.2 trillionThat’s a $25 trillion distinction — the distinction is… pic.twitter.com/sfneKs7JVV

— Alpharactal (@Alphractal) November 1, 2025

The dimensions of the Individuals’s Financial institution of China’s strikes is akin to its response throughout previous crises. By offering extra funds, central banks hope to decrease borrowing prices and stimulate credit score progress.

Such stimulus might additionally broaden the worldwide cash provide, contributing to asset inflation in shares and cryptocurrencies.

Traditionally, main rallies in Bitcoin have been preceded by simultaneous liquidity will increase by the Fed and Individuals’s Financial institution of China. The 2020-2021 bull market occurred in parallel with aggressive financial easing within the wake of the coronavirus outbreak.

Cryptocurrency merchants are presently eyeing an analogous development, as elevated liquidity could lead buyers to hunt different belongings to hedge towards foreign money declines.

China’s liquidity reveals a stronger correlation with Bitcoin value than the US

Many analysts nonetheless focus solely on US macroeconomic information, however in fact the US affect can’t be denied.

However for nearly twenty years, different world powers have emerged… https://t.co/oy0RUtaGHX— Joan Wesson (@joao_wedson) November 1, 2025

Macro analysts have described the scenario as a “liquidity tug of battle” between the US and China. The Fed is attempting to steadiness inflation and monetary stability, whereas the Individuals’s Financial institution is attempting to foster progress with out including extra debt. The outcomes will affect threat urge for food and set the tone for asset efficiency in 2025.

Bitcoin macro outlook relies on continued liquidity

Bitcoin costs have been secure in latest weeks, remaining inside a slender vary as merchants weigh the affect of central financial institution actions.

Bitcoin (BTC) value efficiency. Supply: TradingView

The Pioneer cryptocurrency has proven indicators of consolidation, with open curiosity dropping from over 100,000 in October to just about 90,000 in early November, in keeping with Coinglass information. This decline indicators warning amongst derivatives merchants.

Regardless of subdued exercise, the surroundings may very well be optimistic for Bitcoin if world liquidity continues to broaden. Decrease inflation and an increasing cash provide in america encourage risk-taking.

Many institutional buyers now view Bitcoin as a retailer of worth, particularly at a time when monetary growth is straining the buying energy of conventional currencies.

Nevertheless, Bitcoin’s rise could rely on central financial institution choices. Any optimistic momentum might rapidly dissipate if the Fed reduces liquidity early, whether or not by scaling again repo operations or unexpectedly elevating rates of interest.

Equally, if China’s stimulus package deal fails to revive the economic system, world threat sentiment might weaken, impacting speculative belongings.

The approaching weeks will reveal whether or not central banks will keep liquidity assist or prioritize reining in inflation. Within the case of Bitcoin, the end result might decide whether or not there may be one other sturdy bull market in 2026 or whether or not the value merely continues to say no.

The put up Bitcoin eyes liquidity battle as Fed injects $29 billion as Chinese language market floods The put up appeared first on BeInCrypto.