Bitcoin BTC$113,104.75 and ether Ethereum$4,001.69 About $17 billion value of choices will expire on Deribit on Friday, making it one of many largest month-to-month choices expirations this 12 months.

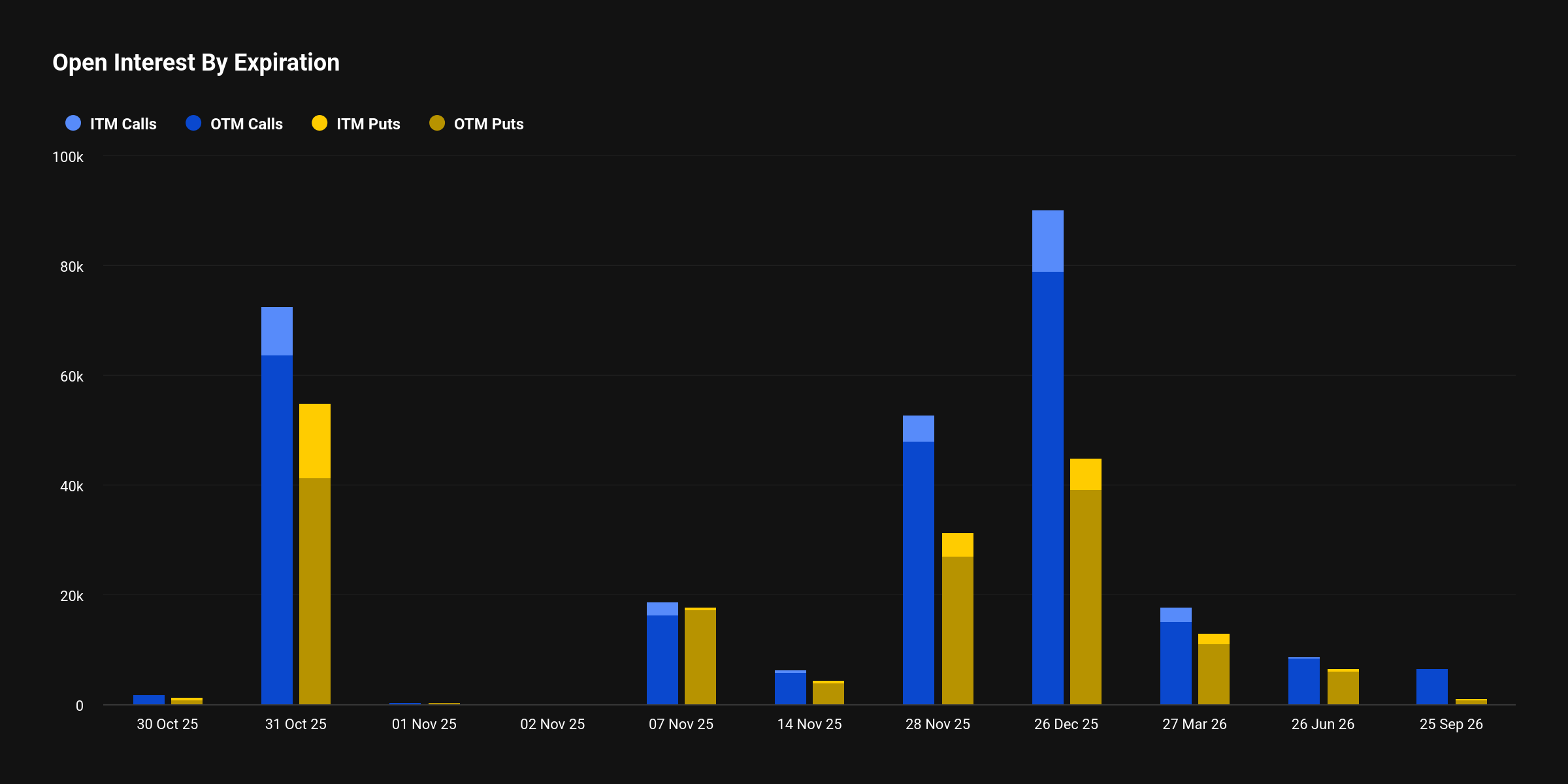

There are 72,716 BTC name choice contracts and 54,945 BTC put choice contracts expiring, representing a complete notional open curiosity of roughly $14.4 billion.

Markets are bracing for a possible spike in volatility because the Federal Reserve meets in the present day to set U.S. rates of interest and massive tech corporations are scheduled to report earnings this week.

An choice is a spinoff contract that offers an investor the proper to purchase or promote an underlying asset at a predetermined value earlier than a selected date. Put choices act as insurance coverage towards falling costs, whereas name choices present the proper to purchase and signify a bullish guess on the underlying asset.

Out-of-the-money (OTM) choices accounted for 82.5% of open curiosity, indicating a transparent desire for speculative positions. This implies that whereas some merchants could also be utilizing OTM choices as a hedge towards sharp value actions, general positioning displays expectations of elevated volatility and enormous market strikes.

Each calls and places are concentrated within the OTM area, with important name curiosity round strike costs of $120,000 and $130,000, and places are dominant at $100,000 and $110,000.

Open curiosity till expiration (Deribit)

Bitcoin is buying and selling round $113,000 and the market is pulling in the direction of the utmost ache degree of $114,000. This represents the value at which most choice contracts, each calls and places, expire nugatory, ensuing within the least financial loss for the choice author and the best financial loss for the choice holder.

As Bitcoin trades near the utmost ache degree, market maker hedging exercise might pull the value development in the direction of Bitcoin earlier than expiration, however that is only a principle.

Ether choices have name curiosity of 375,225 ETH and put open curiosity of 262,850 ETH, representing a complete nominal worth of $2.6 billion, with a most ache degree of $4,110 in comparison with the present value of roughly $4,000.

In keeping with Checkonchain, earlier than IBIT launched choices in November 2024, Deribit managed roughly 80% of the world’s Bitcoin choices open curiosity. Its share has since declined to 44%, equaling IBIT’s market share.