Bitcoin grabbed the eye of the market in the present day with a value of $113,171, a market cap flex of $2.25 trillion, and a 24-hour buying and selling quantity of $67.17 billion. With intraday fluctuations starting from $112,249 to $116,041, Bitcoin is not only transferring, it’s tangoing between stress and seduction.

Bitcoin chart outlook

Let’s discuss in regards to the huge image. On the every day chart, Bitcoin has recovered from a pointy decline after hovering at $126,272. The “double high” left a scar, sending the value all the way down to $103,530 earlier than rebounding right into a lukewarm consolidation vary between $113,000 and $114,000.

The amount right here tells the true story. It’s intense in the course of the fall and weaker in the course of the rise. Merchants aren’t nibbling, they’re nibbling. With resistance at $116,000-$117,000 and psychological assist at $110,000, Bitcoin’s present ranges really feel extra like a ready room than a launching pad.

BTC/USD 1-day chart through Bitstamp for October 29, 2025.

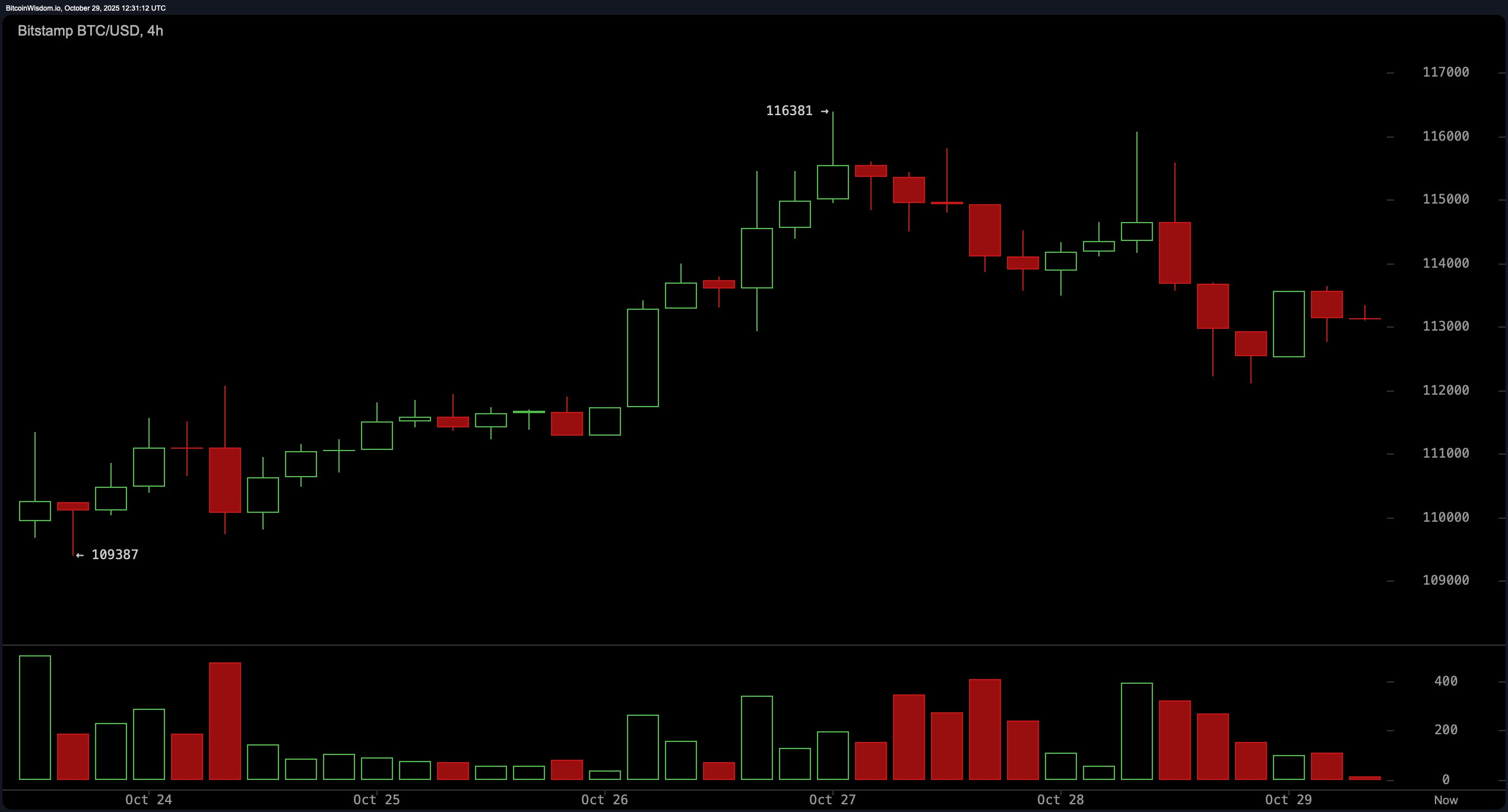

If we zoom in on the 4-hour chart, we will see that Bitcoin is experiencing a mid-tier identification disaster. After failing to carry floor at $116,381, it’s surrounded by pink candles and stalling close to $113,000, the place quantity is growing. In different phrases, distribution is up within the air. Bearish divergences are spreading quicker than gossip on the buying and selling ground. The medium-term bias will probably be to the south till we will confidently get better $114,500. Lower than $112,000? This can be a $110,000 to $108,000 alumni dedication.

BTC/USD 4-hour chart through Bitstamp on October 29, 2025.

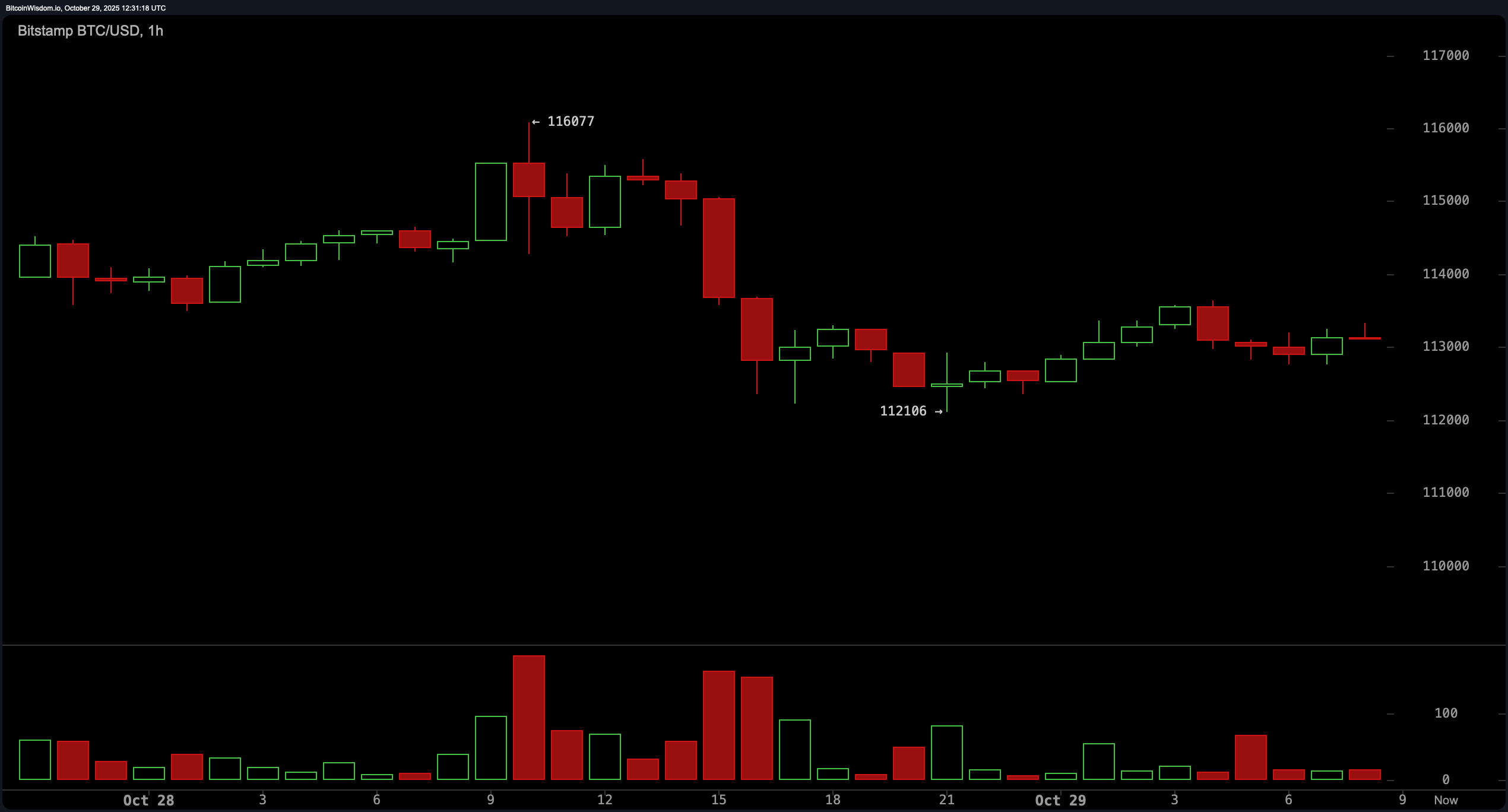

On the hourly chart, Bitcoin is acting at par with the market prowlers. The sharp drop from $116,077 to $112,106 has set the stage for what now seems like a small-volume sport of “Will it?” Merchants are scalping inside a slim vary. It prices $112,000 for the underside bouncer and $114,000 for the highest velvet rope. A rebound from the decrease vary may ship it rapidly to $114,000, however a rejection there’s more likely to push it again to $112,500. What is the environment like? No dedication, however not boring.

BTC/USD 1-hour chart through Bitstamp on October 29, 2025.

Now let us take a look at technical indicators. The oscillator is virtually shrugging. The Relative Energy Index (RSI), Stochastics, Commodity Channel Index (CCI), Common Directional Index (ADX), and the Nice Oscillator are all in impartial territory. Momentum is the one bearish participant on this get together, whereas the transferring common convergence-divergence (MACD) is exhibiting a weak bullish pattern. What about transferring averages? Quick-term exponential and easy transferring averages (10-30) present assist, however over longer spans (50-100) the indicators begin to be combined, and the extra you zoom out, the extra promote flags pop up. It is like Bitcoin has one foot on the gasoline and the opposite on the brake.

Feelings spanning a number of time frames paint a narrative of contradictions. Whereas macro circumstances recommend a corrective rebound at finest, he says he’s “unimpressed” with medium-term momentum and is making an attempt to strengthen his resolve within the brief time period. Till Bitcoin makes a decisive transfer above $114,500 or falls under $112,000, it is going to stay in technical limbo. Merchants ought to maintain one eye on the chart and the opposite on the amount. As a result of when it speaks, it typically screams.

Bullish verdict:

If Bitcoin sustains above $114,500 on sturdy quantity and sustains that stage as assist, the bulls may regain management. This transfer indicators contemporary shopping for momentum and opens the door to a retest of the $116,000-$117,000 resistance zone, which may result in an extra break above if it good points confidence.

Bear verdict:

If Bitcoin loses the $112,000 assist on heavy quantity, count on gravity to do its job. The breakdown right here validates the bearish momentum on each the 1-hour and 4-hour charts, revealing a path to $110,000 and doubtlessly revisiting a deeper assist zone close to $108,000.

Steadily requested questions 💡

- What’s the present value of Bitcoin? Bitcoin is buying and selling at $113,171 as of October 29, 2025.

- What’s Bitcoin’s market capitalization in the present day? Bitcoin’s market capitalization is $2.25 trillion.

- What’s Bitcoin’s buying and selling vary within the final 24 hours? Bitcoin has fluctuated between $112,249 and $116,041 over the previous day.

- Is Bitcoin at the moment in an uptrend or a downtrend? Bitcoin is at the moment vary sure, with bearish strain on increased time frames.