Simply 24 hours after its debut, Hyperliquid’s Inventory Perpetual Buying and selling (Inventory Purp) generated practically $100 million in buying and selling quantity. Regardless of this success, open curiosity was capped at $66 million.

This launch has sparked intense debate throughout the crypto and DeFi communities, with many questioning whether or not this can be a “nice alternative” for an on-chain marketplace for fairness investments. Others surprise if that is only a high-stakes experiment constructed on weak assumptions.

New alternatives: 24/7 liquidity and the evolution of zero-day choices

Hyperliquid’s spectacular launch of its perpetual fairness product has sparked debate within the funding neighborhood. What units Fairness Knowledgeable aside is its potential to remodel conventional inventory markets into a whole 24/7 on-chain buying and selling ecosystem.

In contrast to conventional inventory exchanges, which solely function for a number of hours a day, on-chain fairness derivatives allow steady, borderless and clear buying and selling, in step with DeFi’s ethos of open, permissionless markets.

Tremendous liquid inventory market. Supply: Hyper Liquid

Analysts argue that fairness PERPs should not supposed to switch conventional inventory futures, however moderately to disrupt zero-day choices (0DTEs), a product favored by short-term speculators searching for leverage. As Carbyonzio defined, inventory criminals “do not change inventory futures; they change zero-day choices.”

This modification is according to a widespread want for leverage in trendy markets. José María Macedo famous that Robinhood earns practically $1 billion a yr from choices buying and selling alone, or about 25% of its whole income, indicating an enormous demand for leveraged publicity. Fairness criminals may doubtlessly fill this hole on-chain and supply an easier, extra decentralized various.

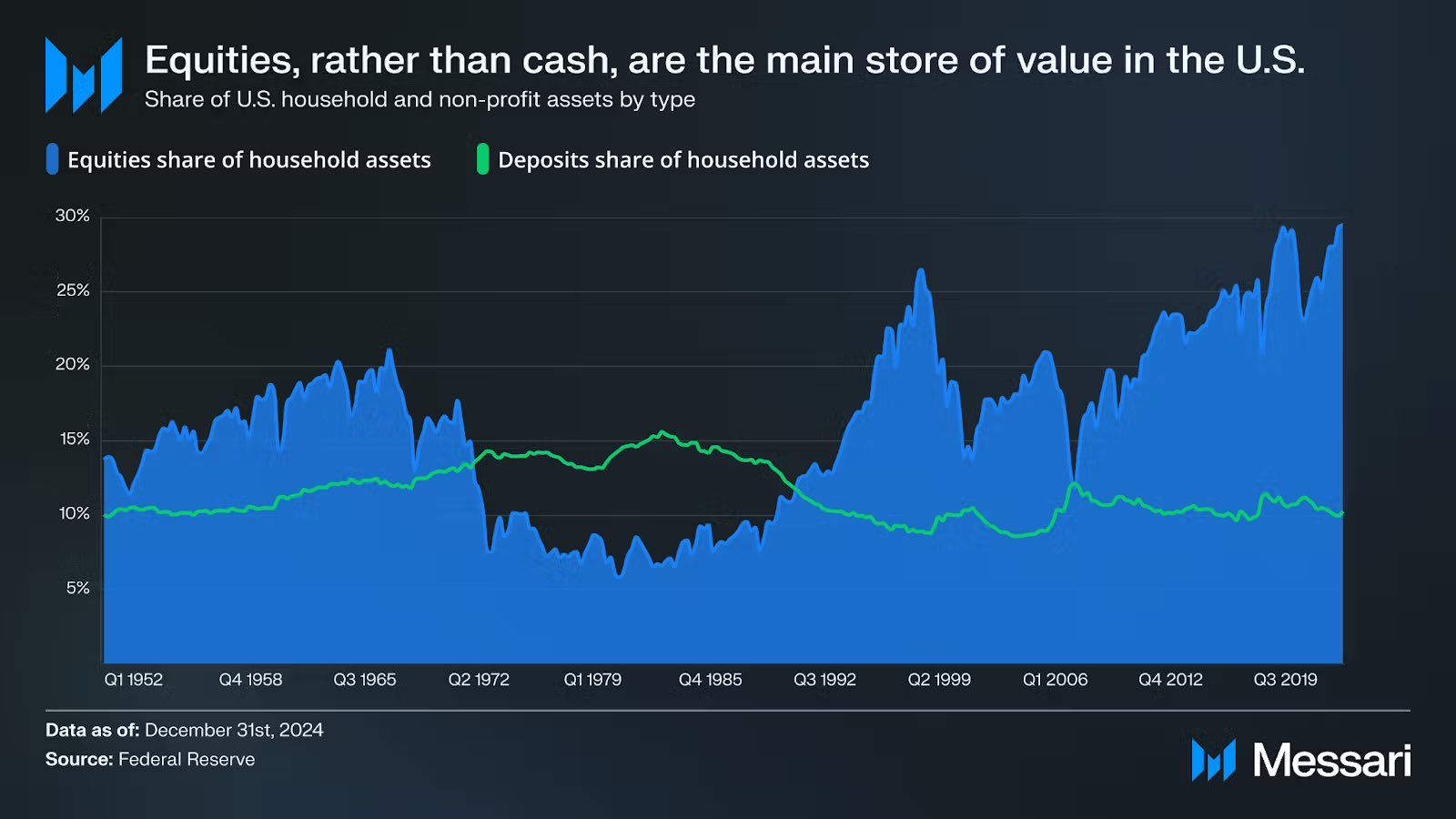

Some trade observers even imagine that inventory crime may rival crypto crime and stablecoins in scale. Ryan Watkins predicts that international fairness investing will likely be an important development alternative for cryptocurrencies over the subsequent 12-18 months, doubtlessly outpacing stablecoins. Dylan G. Bain echoes this view, suggesting that fairness PERP Whole Addressable Market (TAM) may ultimately “outperform stablecoins” as soon as mainstream adoption begins.

Inventory share. Supply: Dylan G. Bain

Dangers and realities: authorized gaps and market depth

Regardless of the thrill, a number of outstanding voices are sounding the alarm. DCinvestor criticized perpetual contracts as inherently biased and warned that exchanges usually have visibility right into a dealer’s liquidation level, permitting for “liquidation looking” in illiquid environments. Such dynamics will be much more problematic in early-stage on-chain inventory markets, the place liquidity and volatility are shallow.

“Purps is successfully a sport of match-fixing. Even when there is no such thing as a precise match-fixing, until you will have excessive danger administration and portfolio administration abilities, the principles are nearly assured to ultimately result in you shedding and shedding cash,” he wrote.

Moreover, shares are essentially totally different from cryptocurrencies. Shares include dividends, shareholder rights, and authorized protections, none of which translate nicely to decentralized derivatives. One analyst warned that separating shares from their authorized framework could possibly be at odds with long-term funding pursuits, whereas Sam warned that present hiring expectations had been “a lot larger than actuality”.

“The inventory disaster could possibly be a defining second for Hyperliquid. Nevertheless, the trail to adoption is unsure and right this moment’s expectations are a lot larger than actuality,” Sam identified.

The primary operational challenges lie in making a clear danger administration system, clearing safety and regulatory alignment. With out these safeguards, much like “circuit breakers” on conventional exchanges, on-chain fairness personnel may quickly face skepticism and elevated scrutiny from regulators all over the world.

In abstract, on-chain fairness PERP is a strategic innovation with immense potential that bridges the hole between conventional finance and decentralized buying and selling. The enchantment of 24/7 liquidity, excessive leverage calls for, and globally accessible infrastructure is plain. However success first relies on fixing tough issues resembling liquidity, transparency, compliance, and investor safety.

The publish 24/7 On-Chain Shares? Hyperliquid’s Fairness Perps Ignite a DeFi Frenzy appeared first on BeInCrypto.