Bitcoin derivatives merchants have been busy even because the spot value has cooled to round $113,500, about 10% in need of the document of $126,000.

Futures frenzy: CME stays king

Futures and choices markets are beginning to present indicators of heavy positioning and cautious optimism. Open curiosity (OI) in Bitcoin futures at present stands at round $73.8 billion, in line with statistics from Coinglass.com, indicating that merchants are removed from discouraged regardless of the gradual decline in spot costs.

CME stays the dominant participant in futures OI, accounting for 22.7% of the whole, or $16.79 billion. Binance follows with $12.69 billion, adopted by OKX with $3.84 billion, Bybit with $7.59 billion, and Gate with $7.67 billion. The remainder of the leaderboard – Kucoin, Bitget, WhiteBIT, BingX, and MEXC – spherical out the extremely contested second tier.

Over the previous 24 hours, OI on most main exchanges has contracted modestly between 1.6% and 10%, suggesting there was a wave of profit-taking. Nonetheless, BingX and MEXC bucked the development and surged 28.5% and 5.25%, proving that there are nonetheless loads of speculators left available in the market.

Throughout all exchanges, Bitcoin futures OI has been steadily rising since June, reflecting final 12 months’s bullish setup. The regular rise of this indicator together with the value displays a market stuffed with robust beliefs and affect. Merchants are clearly leaning in the direction of volatility as they watch for readability from each macro components and Fed coverage strikes.

Choices open curiosity surges to lifetime excessive

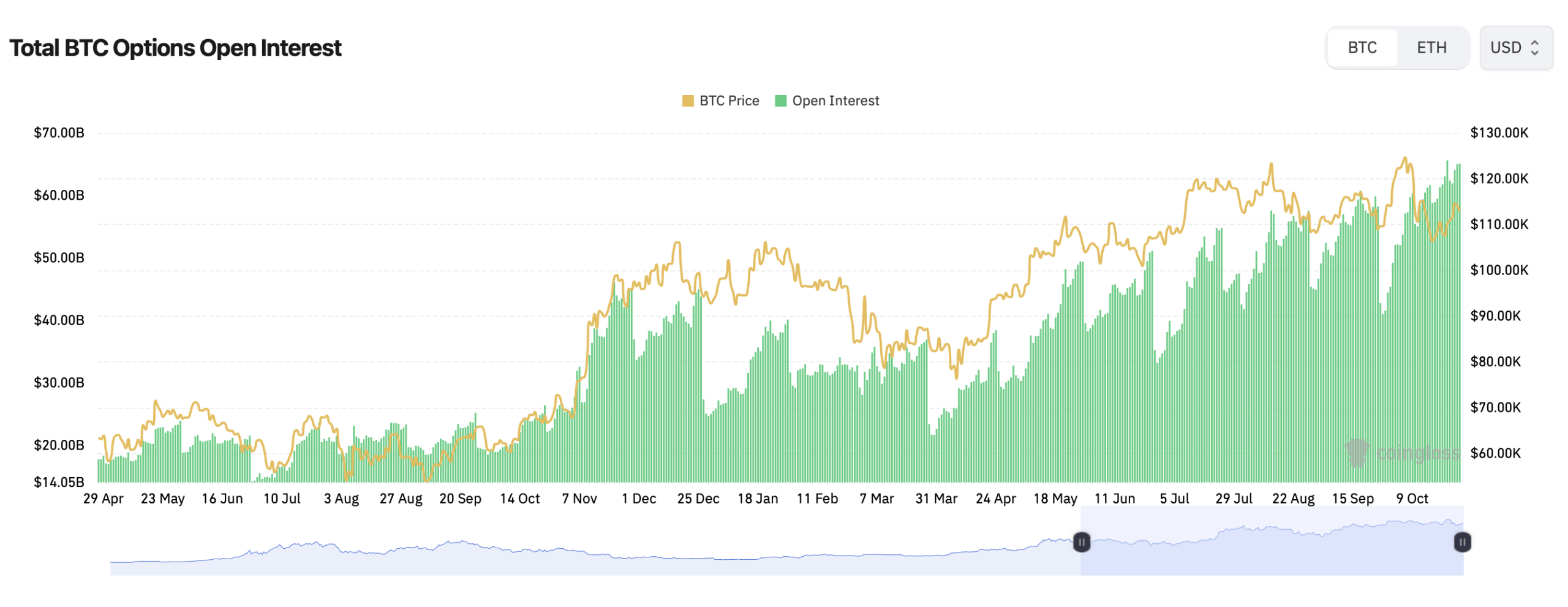

The Bitcoin choices market is at present extra energetic than ever, with notional OI at an all-time excessive of $65 billion. Deribit, which dominates over 90% of this market, has a wholesome bias in the direction of calls (60.2%) over places (39.8%), that means most merchants are betting costs will rise reasonably than fall.

Bitcoin choices open curiosity as of October 29, 2025, in line with Coinglass.com.

Merely put, a name is a bullish contract that takes a revenue if Bitcoin goes up, whereas a put is a bearish contract that takes a revenue if the value goes down. Though this ratio suggests a bullish development, it’s not a trigger for warning. Merchants nonetheless maintain round 200,000 BTC price of places, a giant hedge in case the rally stalls.

The largest bets within the Bitcoin choices market are stacked far into the long run, with contracts not expiring till December 2025. Merchants are eyeing value targets as excessive as $140,000, $150,000, and even $200,000 per coin. It is a clear signal that some market gamers are considering long-term.

The preferred guess proper now’s Deribit’s $140,000 name possibility, which alone equates to over 12,000 BTC in open curiosity. Merely put, the large names are positioning themselves not only for subsequent week’s rebound, however for the subsequent large rally.

In the meantime, short-term buying and selling is displaying robust quantity across the $114,000 to $118,000 name, suggesting merchants are bracing for a potential rebound by the tip of the month.

Bitcoin’s greatest ache level, the value at which possibility patrons lose probably the most and sellers (normally monetary establishments) revenue, is hovering round $114,000. This comes at a time when spot costs are within the doldrums, hinting at a battle of wills between bulls defending the $113,000 vary and possibility writers smiling all the way in which to expiration.

Bitcoin could also be off its highs, however its derivatives ecosystem is hotter than ever. Futures positions are close to document ranges, and choices merchants are piling up long-term calls like collectibles. No matter whether or not Bitcoin’s subsequent transfer is up or down, one factor is for certain: Wall Road and crypto natives alike are in a bind within the derivatives area.

Incessantly requested questions 🧠

- What’s the present complete Bitcoin futures open curiosity? Bitcoin futures OI is roughly $73.8 billion throughout all exchanges, led by CME and Binance.

- Why are non-obligatory OI ranges essential?These point out how a lot capital is tied up within the Bitcoin choices market and are a key indicator of speculative exercise and sentiment.

- What does “most ache” imply in Bitcoin choices?That is the value degree the place most choices merchants are inclined to lose cash at expiration and market makers make earnings.

- Are merchants extra bullish or bearish now?Total sentiment is bullish, with about 60% of open choices being calls that guess on increased costs.