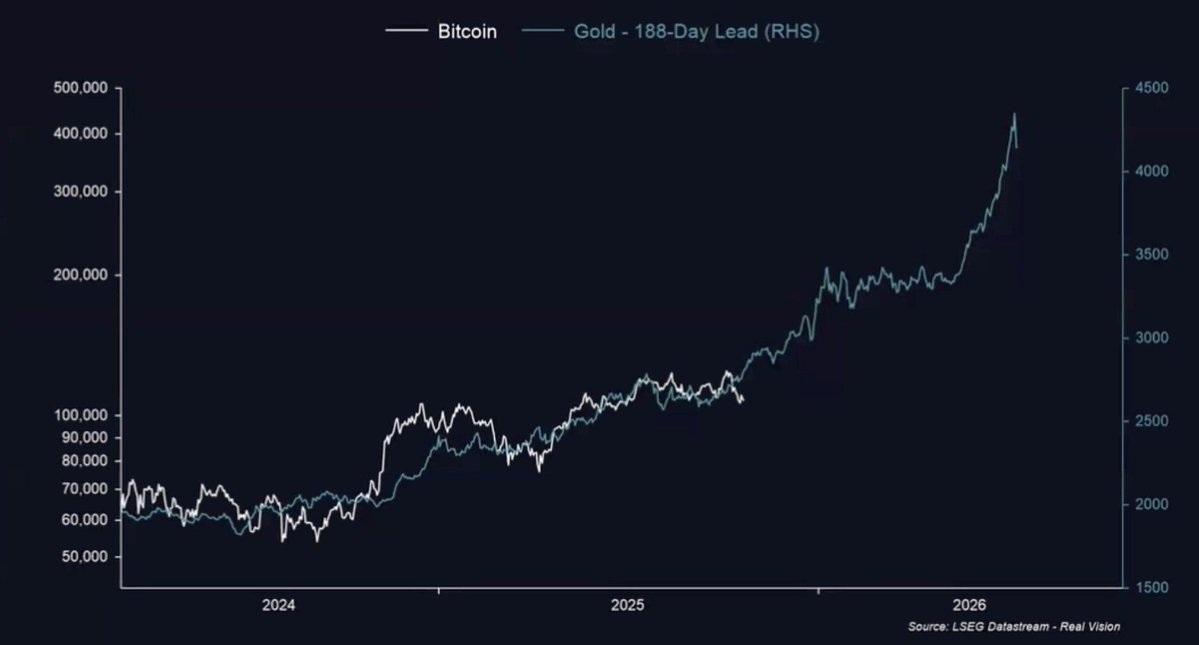

In keeping with a not too long ago shared chart, Bitcoin lags gold value actions by about 188 days.

In keeping with analysts, this case is taken into account a bullish sign for the cryptocurrency market.

This chart compares Bitcoin and gold charges for the interval 2024-2026 based mostly on LSEG Datastream and Actual Imaginative and prescient information. Regardless of the time distinction, Bitcoin’s line is above gold’s correction curve.

Amid continued financial uncertainty, gold is up 45% because the starting of 2025, whereas Bitcoin is up about 20% over the identical interval. Nonetheless, analysts argue that the 188-day hole signifies an impending acceleration in Bitcoin’s value development.

This development can also be believed to be associated to the rise in institutional funding in Bitcoin ETFs. Analysts like RealVision founder Raul Pal incessantly cite these historic correlations.

However, the correlation between Bitcoin and gold is barely 0.09, indicating that Bitcoin nonetheless has an analogous volatility construction as know-how shares.

A picture evaluating the BTC value chart and the gold chart.

Contemplating the picture shared by Actual Imaginative and prescient, it’s claimed that BTC value may exceed $400,000 in 2026.

*This isn’t funding recommendation.