The Financial institution for Worldwide Settlements (BIS) has warned of the dangers of stablecoin yield merchandise. The group warned that the addition of yield blurs the traces between fee instruments and investments.

The Financial institution for Worldwide Settlements (BIS) has issued a warning concerning the growth of stablecoin yield merchandise. The group notes present tendencies in stablecoin adoption, however warns in opposition to revenue-based apps and merchandise.

As a cryptopolitan reportedBIS has been crucial of stablecoins previously, whereas taking a typically destructive stance in the direction of cryptocurrencies.

“These practices can blur the road between fee devices and funding merchandise. These can compete with financial institution deposits, however are sometimes supplied with out comparable prudential oversight, deposit insurance coverage or transparency, exposing customers to gaps and losses in client safety. ” BIS warned in a latest evaluation.

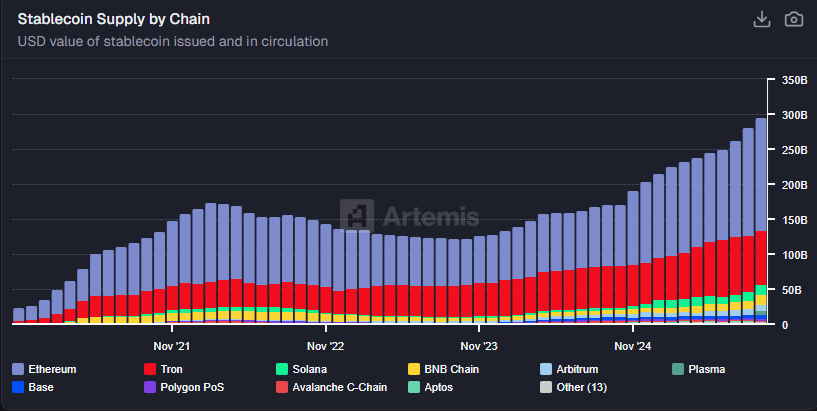

The stablecoin shortly expanded to a complete provide of 305.9 billion tokens, cut up into basic fee belongings and specialised tokens linked to yield-based merchandise. Stablecoins are saved in 42.1 million addresses 4% Up to now month.

BIS warns of conflicts of curiosity in stablecoins and lending companies

BIS has warned that the recognition of stablecoins might create conflicts of curiosity with conventional banks. Moreover, high-yield or lending apps can create conflicts of curiosity. Regardless of the present framework backing stablecoins, the house continues to be unregulated when it comes to yield.

BIS additionally known as for extra regulation for decentralized crypto asset service suppliers (CASPs) that provide yield. There are at present no particular restrictions on decentralized yield and lending protocols, and no protections for retail customers.

One supply of the dispute is that some stablecoins have comparatively excessive financial savings charges, considerably exceeding financial institution deposit charges for U.S. clients. Nonetheless, BIS warned that these yield-bearing merchandise are utterly unregulated and haven’t any security mechanisms for depositors.

“Excessive-yield merchandise that mimic financial savings accounts can expose customers to potential losses and opposed contractual outcomes, corresponding to being handled as unsecured collectors, if the middleman fails. ” I defined about BIS in a latest article. report.

Some stablecoin protocols leverage yield from US Treasury payments, both immediately or by means of tokenized merchandise like BUIDL. Not like banks, protocols share extra of their income with customers. There are exceptions like USDT, which primarily holds curiosity on Treasury payments.

Unbelievable yields depend upon the protocol, not the stablecoin

Stablecoins are accepted by a number of protocols and the ultimate yield varies relying on their decentralized app. Even regulated stablecoins like USDC are finally saved in high-yield vaults or protocols.

Whereas stablecoins expanded their complete provide, in addition they gained further incentives from airdrop farming, growing income alternatives. The entire stablecoin provide is over 305 billion tokens. |Supply: Artemis

At present, many of the liquidity is held in Aave, Morpho, Maple Finance, and Sky Protocol. Nonetheless, there’s a lengthy tail of low-yield merchandise with APYs larger than 100% and even reaching 1,000%. Most merchants nonetheless keep away from these protocols as a result of the yields are unrealistic and unsustainable.

Extra generally, yields for well-liked protocols vary from 4% to 7%. Even these affords are engaging in comparison with financial institution deposits.

Yields from stablecoins typically have further incentives corresponding to airdrop farming. Over the previous 12 months, extra customers have chosen to farm new tokens as a substitute of buying and selling dangerous and risky crypto belongings.