Friday’s Shopper Value Index (CPI) is the one official financial indicator launched whereas the U.S. authorities shutdown continues.

Bitcoin surpasses $111,000 as inflation subsides

The tempo of inflation was slower than many economists anticipated, in line with the most recent CPI report launched Friday morning by the U.S. Bureau of Labor Statistics (BLS). The announcement buoyed markets, as lower-than-expected inflation knowledge supplied a extra convincing case for an rate of interest lower by the Federal Reserve on the finish of the month. Bitcoin briefly rose above $111,000 after the report was launched, rose 2.27%, after which fell to $110,000.

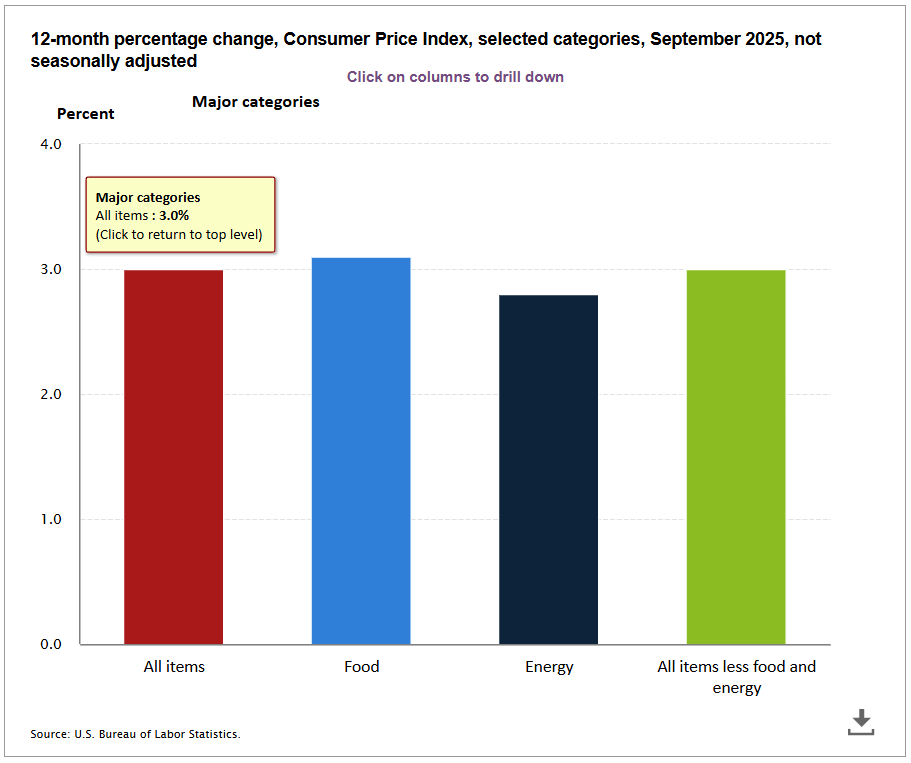

The CPI rose solely 0.3% in September, pushing the inflation fee all the way down to an annual fee of three%. Consultants are predicting a 0.4% rise, which might push annual inflation to three.1%. Core inflation, which excludes the extra unstable classes of meals and vitality, rose 0.2%, however remained at 3% on an annualized foundation. Economists had anticipated barely increased numbers of 0.3% and three.1%, respectively.

(September inflation fee was decrease than anticipated at an annual fee of three%./U.S. Bureau of Labor Statistics)

Because the U.S. authorities shut down in 2024, different official financial experiences had been additionally suspended.th day. An exception was made for the CPI statistics, which had been initially scheduled for October fifteenth. The Fed will use the report back to information its rate of interest selections subsequent week. All forecasts level to a lower in coverage charges, with the CME Fed Software giving a 96.7% probability of a fee lower. On the time of writing, each the crypto and inventory markets have responded positively, with the general crypto market up 1.74% and all main inventory indexes within the inexperienced.

However some are questioning the accuracy of the CPI knowledge and are even cautious of dovish sentiment behind the anticipated fee lower.

“Measuring annual worth will increase utilizing the CPI intentionally underestimates the magnitude of the rise, so the index rose 3% yr over yr in September, 50% above the Fed’s 2% goal,” wrote gold investor Peter Schiff. “Nonetheless, the Fed intends to chop charges once more, including gasoline to the inflationary fireplace it helped gasoline.”

Overview of market indicators

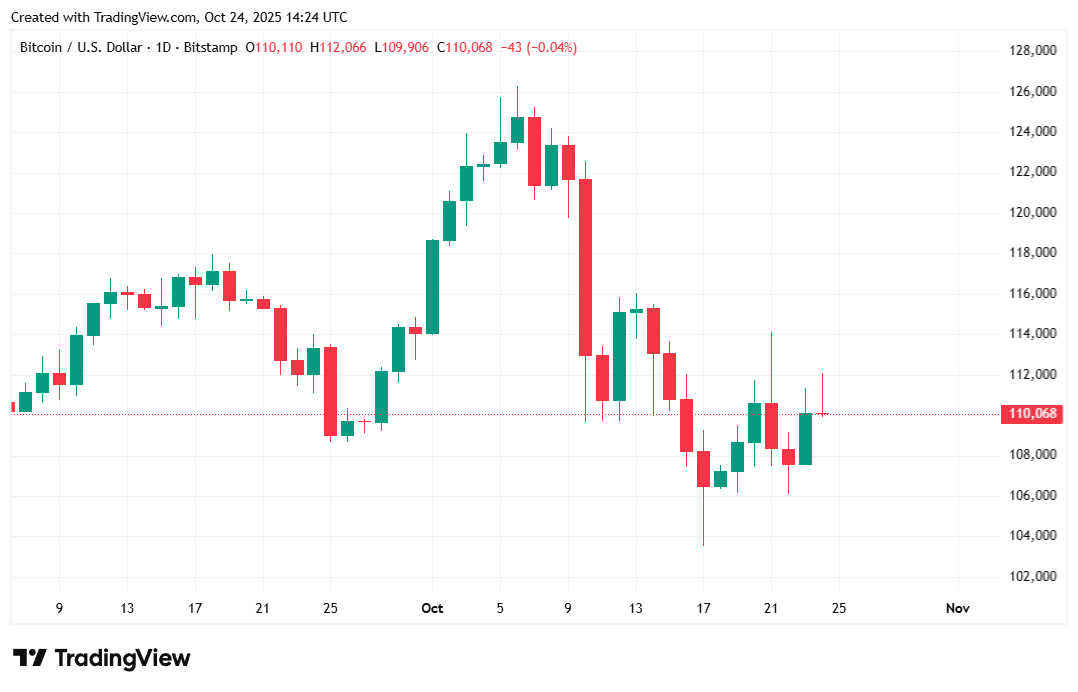

On the time of reporting, Bitcoin was buying and selling at $110,083, up 0.69% on the day and 4.57% over the week, in line with knowledge from Coinmarketcap. The value of the cryptocurrency ranged from $108,802.83 to $111,842.53.

(BTC Value/Buying and selling View)

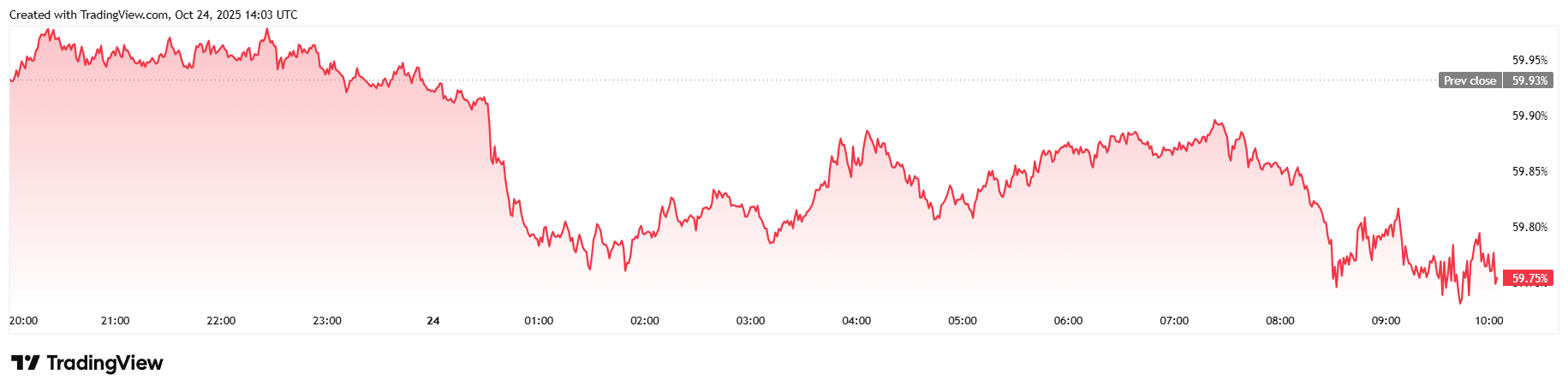

The 24-hour buying and selling quantity decreased by 22.59% to $53.07 billion, however the market capitalization elevated by 1.07% to $2.2 trillion. Bitcoin’s dominance has fallen by 0.29% since Thursday to 59.75%.

(BTC Dominance / Buying and selling View)

The whole worth of open futures contracts elevated by 2.92% in 24 hours to $71.5 billion, in line with Coinglass knowledge. Clearances had been similar to yesterday’s ranges, totaling $66.05 million. Quick sellers accounted for many of this quantity, shedding $49.81 million in margin, whereas lengthy buyers misplaced the remaining $16.24 million.

Regularly requested questions ⚡

-

Why did Bitcoin soar above $111,000?

Weaker-than-expected inflation knowledge has raised expectations that the U.S. Federal Reserve will lower rates of interest later this month. -

What did the most recent CPI report present?

The CPI rose simply 0.3% in September, bringing the annual inflation fee to three%, decrease than economists anticipated. -

How has the market reacted?

Cryptocurrency and inventory markets rebounded, with Bitcoin rising greater than 2% and the general cryptocurrency market rising 2.16%. -

What occurs subsequent?

With a 96.7% chance of a fee lower, merchants count on Bitcoin to stay robust as financial coverage eases.