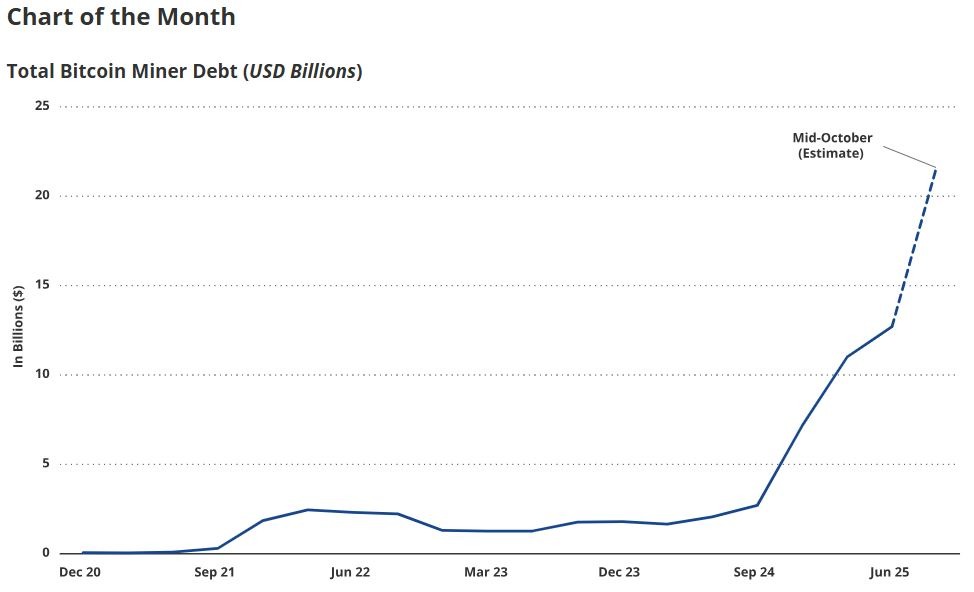

Bitcoin miners’ debt rose from $2.1 billion to $12.7 billion in simply 12 months as they race to fulfill the calls for of synthetic intelligence and Bitcoin manufacturing, in response to funding big VanEck.

With out continued funding in trendy machines, miners’ share of the worldwide hashrate will decline, leading to a decline within the share of Bitcoin (BTC) granted every day, VanEck analyst Nathan Frankowitz and head of digital asset analysis Matthew Siegel mentioned Wednesday of their October Bitcoin Chaincheck report.

“We name this motion the ice-thaw drawback. Traditionally, miners relied on the inventory market somewhat than debt to cowl these excessive capital funding prices.”

“This is because of the truth that miners’ earnings is nearly solely depending on the speculative worth of Bitcoin, making them troublesome to underwrite. Importantly, fairness tends to be a dearer type of capital than debt,” Frankowitz and Siegel added.

Bitcoin miners’ debt has elevated from $2.1 billion to $12.7 billion up to now 12 months. sauce: Van Eck

Business publication The Miner Magazine estimates mixed debt and convertible bond issuance from 15 public miners to be $4.6 billion within the fourth quarter of 2024, $200 million in early 2025, and $1.5 billion within the second quarter of 2025.

Crypto miners transfer into AI

Because the halving in April 2024, when mining rewards will probably be lowered to three.125 Bitcoins, extra Bitcoin miners are diversifying their earnings sources by shifting power capability to AI and HPC internet hosting companies, hurting general profitability.

“In doing so, miners now have a extra predictable money circulation backed by multi-year contracts,” Frankowitz and Siegel mentioned.

“The relative predictability of those money flows permits miners to benefit from the bond market, diversifying their earnings from Bitcoin’s speculative and cyclical costs and decreasing their general price of capital.”

In October, BitFarms accomplished a $588 million convertible debt providing, with proceeds going towards HPC and AI infrastructure growth in North America.

Fellow mining firm TeraWulf additionally introduced a $3.2 billion senior secured debt providing to partially fund a knowledge heart growth at its Lake Mariner campus in Barker, New York.

sauce: terra wolf

In the meantime, IREN additionally accomplished a $1 billion convertible debt providing in October, with some funds designated for basic company functions and dealing capital.

AI pivot just isn’t a risk to the Bitcoin community

Miners are the spine of the Bitcoin community. Validate each Bitcoin transaction and report it in a brand new block. The extra miners that take part, the upper the hashrate, which helps make the community safer.

Associated: Mining Bitcoin simply obtained simpler, but it surely did not final lengthy because the hashrate went wild once more

Frankowitz and Siegel mentioned miners shifting their focus to AI and HPC internet hosting just isn’t a risk to the community’s hashrate, as “AI’s prioritization of electronics is a web profit for Bitcoin.”

“Bitcoin mining is a simple solution to shortly monetize surplus energy in distant and creating power markets, and might successfully subsidize the event of knowledge facilities designed with AI and HPC transformability in thoughts,” they mentioned.

“Moreover, AI inference experiences cyclical calls for all through the day primarily based on human exercise.”

Miners in search of methods to chop prices

On the similar time, a number of miners they spoke to for this report mentioned they’re in search of methods to monetize extra energy capability at a time when demand for AI companies is low.

Frankowitz and Siegel mentioned this might permit miners to offset or eradicate costly backup energy sources reminiscent of diesel mills.

“Though that is nonetheless conceptual, we consider it represents a logical subsequent step within the distinctive synergy between Bitcoin and AI that may result in better effectivity in the usage of each monetary and electrical capital.”

journal: Binance shakes up Morgan Stanley’s safety tokens in South Korea, Japan: Asia Categorical