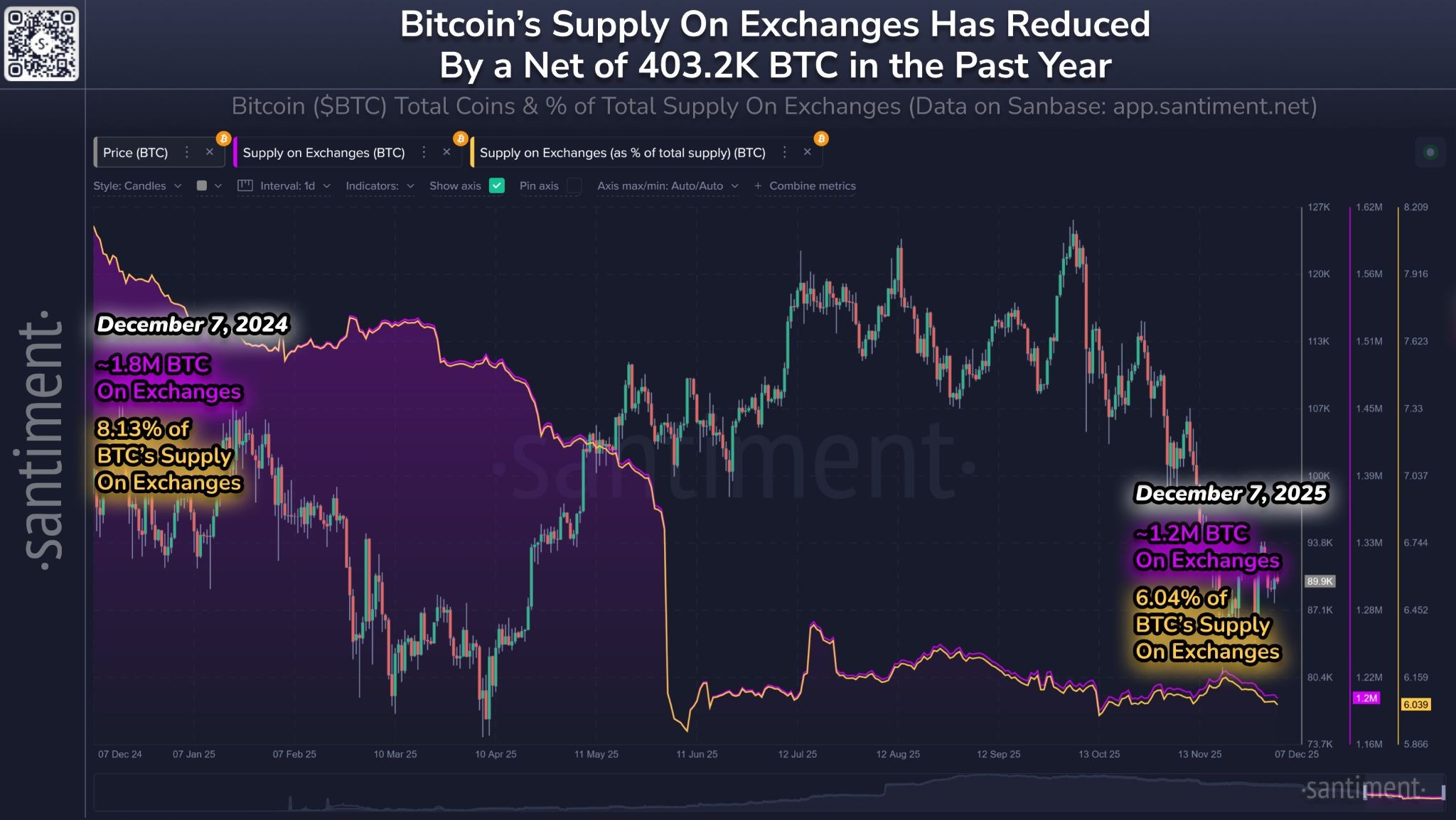

In keeping with market intelligence platform Santiment, the variety of Bitcoins on exchanges is at the least 400,000 fewer than the identical time final 12 months, a optimistic signal for the market.

Greater than 403,000 Bitcoins (BTC) have moved off exchanges since Dec. 7, 2024, representing roughly 2% of the full provide, Santiment mentioned in an X-Publish on Monday, citing information from the Sunbase dashboard.

Customers usually transfer their Bitcoin from exchanges to chilly storage wallets, which theoretically makes it tougher to promote and will sign a long-term plan to carry onto your Bitcoin.

“Usually talking, it is a optimistic sign up the long run. The less cash there are on exchanges, the much less possible it’s that we’ll traditionally see massive declines that trigger downward stress on asset costs.”

“With the market worth of Bitcoin hovering round $90,000, the very best market capitalization of cryptocurrencies continues to be out of provide from exchanges,” Santiment added.

A 12 months in the past, there have been roughly 1.8 million Bitcoins on the alternate. sauce: Saintly

Bitcoin additionally shifts to ETFs

Whereas lots of the bitcoins on exchanges are possible again in Hodler wallets, Yannis Andreou, founder and CEO of crypto mining firm Bitmeln Mining, mentioned exchange-traded funds (ETFs) may be absorbing these cash.

Citing information from BitcoinTresuries.Internet, Andreu mentioned that after years of outflows and ETFs quietly accumulating behind the scenes, ETFs and publicly traded corporations now maintain extra Bitcoin than all exchanges mixed.

Associated: Technique’s Bitcoin Vault Swells to Over 660,000 BTC with $962 Million in New Purchases

“Institutional possession has quietly entered a brand new section: much less liquidity provision, extra long-term holders, extra value reflexivity, and a market pushed by regulatory devices reasonably than buying and selling platforms,” Andreu mentioned.

“This shift is larger than individuals assume. Bitcoin is not transferring to exchanges. It is transferring straight from exchanges to monetary establishments that may’t promote simply. The tightness in provide is growing in actual time.”

ETFs and personal corporations maintain extra Bitcoin than exchanges

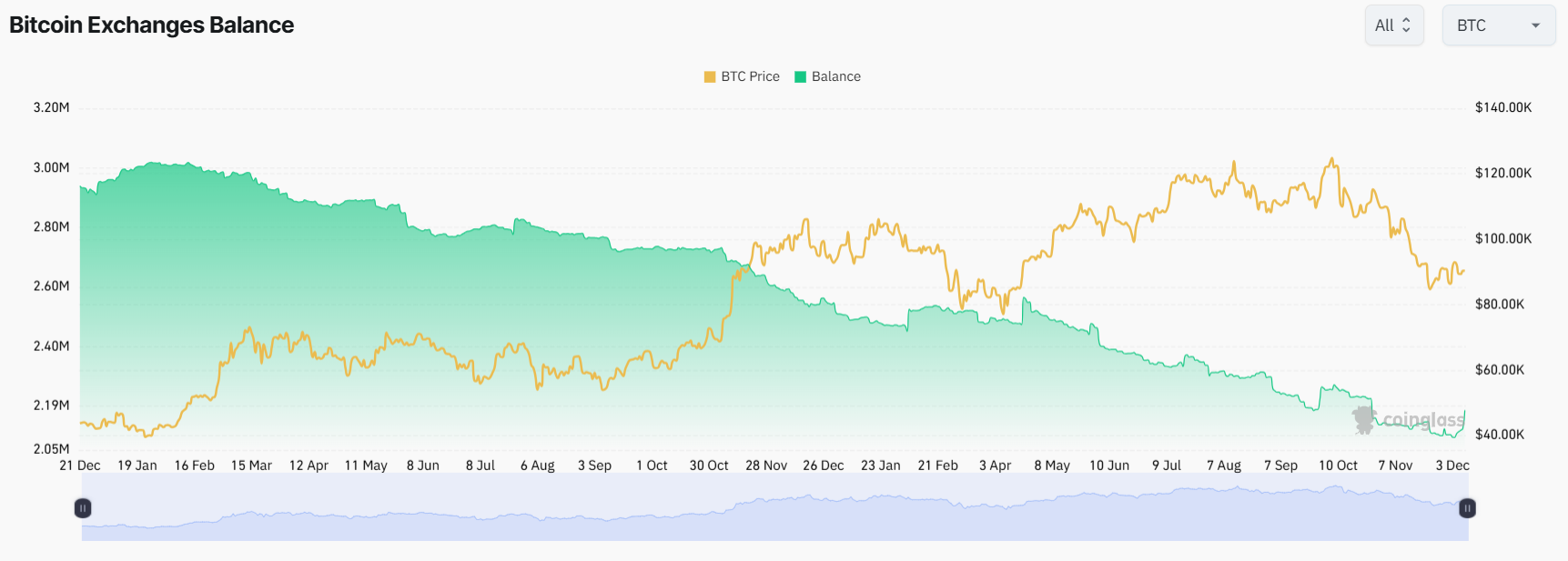

CoinGlass, a crypto information evaluation platform, confirmed an analogous pattern, with solely about $2.11 million in Bitcoin held on its alternate as of November twenty second, at a time when Bitcoin was affected by a correction and was buying and selling at about $84,600.

Bitcoin held on exchanges has been steadily declining over the previous 12 months. sauce: coin glass

BitBo lists ETFs holding greater than 1.5 million Bitcoins and publicly traded corporations holding greater than 1 million, representing almost 11% of the full provide.

journal: South Koreans ‘pump’ alternate options after Upbit hack, China BTC mining surges: Asia Categorical