Asset administration agency 21Shares is exploring the launch of an exchange-traded fund (ETF) that may observe HyperLiquid, the token behind the perpetual futures protocol and blockchain, as Wall Avenue’s curiosity in various cryptocurrencies grows.

The corporate filed for the 21Shares HyperLiquid ETF with the Securities and Trade Fee on Wednesday, however the ticker image and costs weren’t disclosed. Coinbase Custody and BitGo Belief have been appointed as custodians.

This follows an identical submitting from Bitwise final month for the Hyper Liquid (HYPE) ETF. This token can be used to offer reductions on the Hyperliquid decentralized change and pay for charges on its blockchain. Its worth has elevated over the previous yr because the service has grown in reputation.

U.S. traders have proven an urge for food for ETFs monitoring extra risky altcoins, together with new merchandise akin to staking. Bitwise’s new Solana (SOL) ETF posted important buying and selling quantity on its second day available on the market.

Bitwise Solana Staking ETF buying and selling quantity reaches “large numbers”

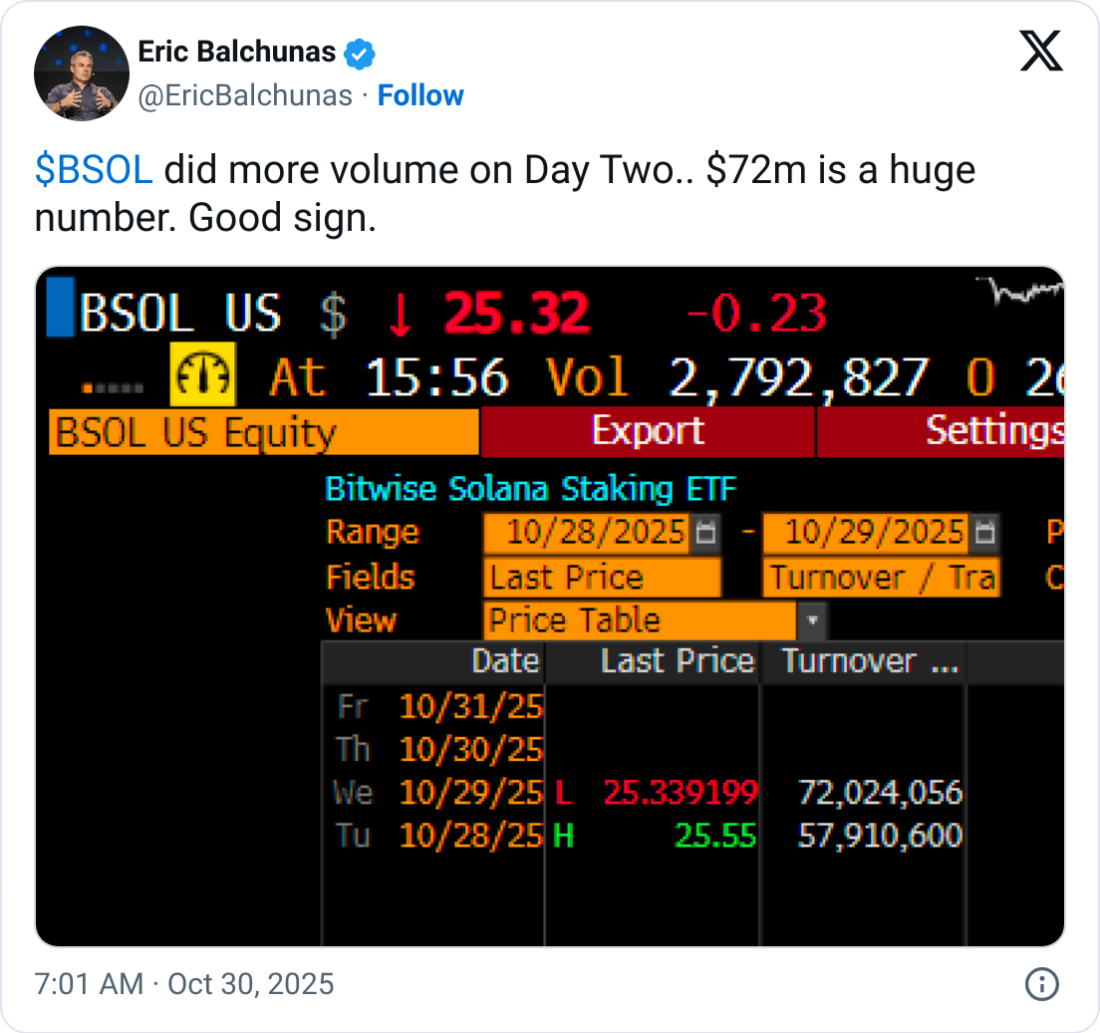

In the meantime, the Bitwise Solana Staking ETF (BSOL) closed its second day of buying and selling on Wednesday with buying and selling quantity of over $72 million.

Eric Balciunas, an ETF analyst at Bloomberg, stated the numbers have been “large numbers” and a “good signal” at a time when most ETF volumes decline “the day the hype ends.”

sauce: Eric Balchunas

BSOL made its buying and selling debut on Tuesday alongside Canary Capital’s Litecoin (LTC) ETF and Hedera (HBAR) ETF. The Bitwise ETF generated buying and selling quantity of $55.4 million, making it the most important crypto ETF launched in 2025, in response to Balchunas.

Associated: Solana Staking ETF is ‘lacking a chunk of the puzzle’: Bitwise CIO

Grayscale Investments additionally on Wednesday debuted the staking-enabled Grayscale Solana Belief ETF (GSOL), which rivals an identical ETF from Bitwise.

However Balciunas stated GSOL’s buying and selling quantity was $4 million in its debut, which he known as “wholesome, however (clearly) not so good as BSOL.”

“Only a day’s delay is definitely a very massive deal,” he added. “It may be very troublesome.”

journal: Sharplink executives shocked by BTC and ETH ETF holdings — Joseph Chalom