13 years in the past in the present day, Bitcoin skilled its first halving occasion, lowering miner block rewards from an preliminary 50 BTC to 25 BTC.

Up to now, Bitcoin (BTC) has accomplished 4 halving occasions, the block reward stays at simply 3.125 BTC, and the mining business continues to remodel as miners combine and diversify with AI.

In accordance with Bitfinex analysts interviewed by Cointelegraph, a distinct segment development known as solo mining can also be rising.

“Regardless of the brand new surge in industrial Bitcoin mining, we want to spotlight how a brand new wave of particular person miners and hobbyist miners are returning to the market due to improved mining swimming pools, elevated effectivity, and area of interest methods,” the analysts stated.

Bitcoin mining in 2024 and 2025: competitors will increase as manufacturing declines

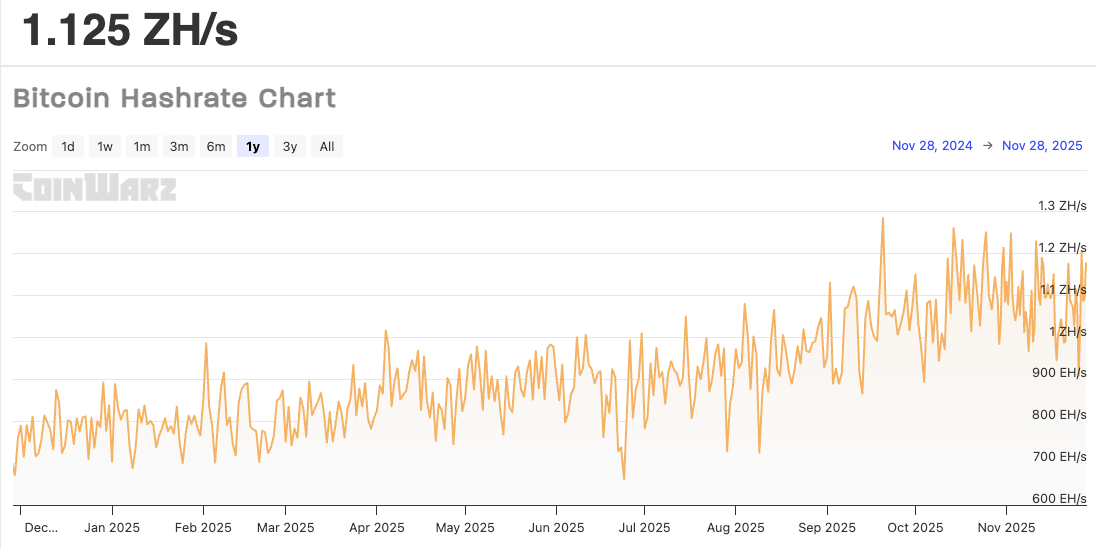

Since final 12 months, the Bitcoin mining market has grown considerably in dimension, complexity, and competitiveness, with the worldwide hashrate exceeding the long-lasting 1 zetahash per second (ZH/s) in August, in response to knowledge from CoinWarz.

“This displays each elevated funding and the introduction of ultra-efficient mining {hardware} such because the Antminer S21 collection,” Bitfinex analysts stated. “Briefly, the Bitcoin mining market in 2025 can be extra industrialized, technologically superior, and geographically dispersed than in 2024, but in addition extra aggressive and risky.”

Bitcoin hashrate chart from December 2024 to November 2025. Supply: CoinWarz

Regardless of elevated competitors, mine manufacturing has declined over the previous 12 months. In accordance with Blockchain.com, the circulating provide of Bitcoin elevated by roughly 155,000 BTC from November 27, 2024 to November 27, 2025, down 37% from 245,000 BTC the earlier 12 months.

“2024 has already been a tricky 12 months for miners,” Christian Sepser, chief advertising officer at BTC mining expertise supplier Brainins, advised Cointelegraph, including that miners are deploying {hardware} at report pace.

Associated: Bitcoin miner hash value approaches $40, miners return to “survival mode”: report

Nonetheless, Csepcsar added that regardless of the rise in BTC costs, revenues continued to say no as hash costs, and due to this fact miners’ income per unit of hash energy, plummeted as a result of elevated mining competitors.

Bitcoin’s Hash Value Index hit an all-time low of $34 on November 21, 2025. supply: HashrateIndex.com

“2024 was a tough 12 months. Right now is even worse. Miners are in essentially the most aggressive setting the business has ever seen, and nobody is aware of how lengthy this may final,” Chepser stated.

Private and interest mining returns to market

Regardless of growing industrial competitors and rising prices, impartial miners will not be going away. As an alternative, they’re re-entering the market, supported by varied enhancements in mining pool expertise, in response to Bitfinex analysts.

“Instruments reminiscent of CKPool, a platform appropriate for solo mining recognized for its low latency, are serving to to make this observe extra accessible,” the analyst stated. The corporate additionally noticed that “successful the lottery” by particular person miners, particularly these utilizing environment friendly, low-noise mining tools at dwelling, was turning into extra prevalent in society.

sauce: pink panda mining

“Interest mining, whereas not fully private or industrial, is present process a mini-renaissance,” Bitfinex analysts stated, including that this development has been pushed by the provision of environment friendly, low-cost ASICs, using off-peak energy methods, warmth recycling strategies, and firmware reminiscent of BrainsOS, which permits miners to underclock their gadgets for optimum effectivity.

Associated: Tether confirms withdrawal from Bitcoin mining in Uruguay amid hovering vitality costs

“Since we’re speaking about common customers with restricted hashrate out there, it’s unlikely that these teams will seize hashrate management in a capitulation situation,” the analyst stated.

If the biggest miners capitulate considerably, medium-sized industrial operations will grow to be the brand new main gamers, whereas particular person miners and hobbyists will nonetheless be far behind them by way of manufacturing capability, Bitfinex stated, concluding:

“It is an fascinating sample, however it’s a great distance from competing with bigger, extra industrial operators.”

journal: South Koreans ‘pump’ alternate options after Upbit hack, China BTC mining surges: Asia Specific